Technology Explained

How to Set or Change Your Default Google Account

Introduction: Default Google Account

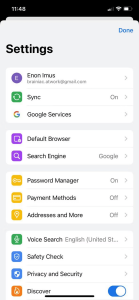

Managing multiple Google accounts can be challenging, especially when you want to ensure easy access to the one you need. In this guide, we’ll explore how to set or change your default Google account to enhance your online experience and streamline your workflow.

Why Changing Default Google Account Matters

Having multiple Gmail and Google accounts is common, but designating a primary account for your activities can save time and prevent confusion. Whether you use separate accounts for work and personal purposes or require distinct language settings, understanding how to manage your default Google account is crucial.

Image by https://www.makeuseof.com/

Steps to Change Your Default Google Account

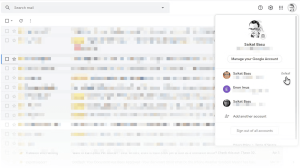

By default, Google uses the first account you log in with as your primary account. However, you can easily change this setting. Follow these steps:

Visit any Google sign-in page in a regular browser window.

Sign out of all your Google accounts by clicking your profile picture at the top-right and selecting “Sign out.”

Navigate to gmail.com and log in with the Google account you want to set as the default.

This account will now become your default. You can confirm this by signing into other Google services like Google Drive.

If you need to access other accounts, click your profile picture, select “Add account,” and sign in with the desired account.

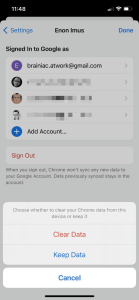

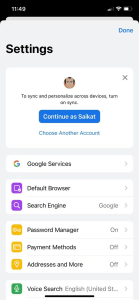

Managing Multiple Google Accounts on Mobile

On mobile devices, having a primary account is even more crucial due to syncing and backup functions. Here’s how to manage multiple accounts on Android and iOS:

Use your default account for most services, as switching accounts can be app-specific.

For multiple sign-ins, log out of all accounts and sign in again with the account you want to use.

- Image by https://www.makeuseof.com/

- Image by https://www.makeuseof.com/

- Image by https://www.makeuseof.com/

Additional Tips for Efficient Account Management

Managing multiple Google accounts doesn’t have to be overwhelming. Here are some extra tips to streamline the process:

Use distinct profile images for each Google account to easily identify them.

Utilize your browser’s Incognito mode to temporarily access a different account.

Sign in to your accounts in your preferred order and close tabs for accounts not in use.

Set up sharing privileges for commonly used files and folders between accounts.

Use tools like Google Backup & Sync for efficient data management.

Employ different Chrome profiles for various Google accounts to keep them organized.

Consider using browser extensions like SessionBox for managing different sign-ins.

Set up email forwarding between Gmail accounts for important communications.

Use the Gmail Label Sharing extension to share labels across multiple accounts.

Uncheck the “Stay signed in” option for more control over your log-ins.

Conclusion

Setting or changing your default Google account is a simple yet effective way to enhance your online productivity. By understanding the process and implementing the provided tips, you can manage multiple accounts with ease and ensure a smoother digital experience. Whether you’re using Google for personal or work-related tasks, optimizing your account management will save you time and energy in the long run.

Digital Development

Boldify for Facebook: Quick Bold Text in Seconds

Scroll through Facebook for just five minutes and you’ll notice something: most posts look exactly the same. Plain text blends into the feed, making it easy for users to scroll past without noticing important messages. In a crowded social media environment, visual formatting plays a major role in grabbing attention and increasing engagement. This is where Boldify, a powerful bold text generator, makes a difference. Instead of struggling with plain, unformatted posts, Boldify allows you to create eye-catching Facebook bold text instantly. In this article, you’ll learn why bold text matters, how Boldify works, and how you can use it to stand out on Facebook within seconds.

Why Bold Text Matters on Facebook (User Engagement Psychology)

Facebook is a fast-moving platform. Users scroll quickly, often stopping only when something visually stands out. Bold text works because it creates contrast. When certain words appear heavier or more prominent, the brain processes them faster.

Here’s why bold text improves engagement:

- It grabs attention in crowded feeds.

- It improves readability and scan ability.

- It highlights key messages instantly.

Bold formatting is especially powerful in:

- Facebook posts

- Comments

- Bios

- Facebook groups

If you’re building a brand or growing a personal profile, bold text strengthens your identity. It emphasizes important announcements, promotions, or calls to action, making your message harder to ignore.

The Challenge: Facebook Doesn’t Offer Built-In Bold Formatting

One of the biggest frustrations for users is that Facebook does not provide built-in bold formatting for regular posts. Unlike word processors, you cannot simply select text and click “Bold.”

That’s why many people search for:

- how to bold text on Facebook

- Facebook bold text generator

- bold letters for Facebook

Without a proper tool, users are left copying complicated codes or trying ineffective formatting tricks. This creates a clear need for a reliable and easy-to-use bold font generator.

What Is Boldify?

Boldify is an online bold text generator designed to help users create stylish bold letters instantly. Instead of modifying Facebook’s formatting, Boldify uses Unicode-based bold fonts that are fully compatible with social media platforms.

Here’s what makes Boldify simple and powerful:

- No installation required

- Works directly in your browser

- Free and instant access

- Compatible with Facebook, Instagram, Twitter, and WhatsApp

Because it uses special Unicode characters, the bold text appears naturally once pasted into Facebook posts, comments, bios, or Messenger chats. This makes Boldify a practical and beginner-friendly solution for anyone looking to create bold text online.

How Boldify Helps You Create Bold Facebook Text in Seconds

Using Boldify is straightforward and requires no technical knowledge. Here’s a simple step-by-step guide:

Step 1: Enter Your Text

Open Boldify and type your message into the input box. This could be a status update, promotional message, announcement, or bio line.

Example:

New Blog Post Live

Limited Time Offer

Join Our Community Today

Step 2: Automatic Bold Conversion

As soon as you enter your text, Boldify automatically converts it into multiple bold font styles. Within seconds, you’ll see several variations generated instantly.

Step 3: Copy and Paste to Facebook

Choose the bold style you like, click the copy button, and paste it directly into:

- Facebook posts

- Comments

- Bios

- Messenger chats

That’s it. In just a few seconds, your plain text becomes visually powerful Facebook bold text.

Key Features That Make Boldify Stand Out

There are many tools online, but Boldify offers specific advantages that make it reliable and user-friendly.

1. One-Click Copy Feature

No need to manually select text. Just click and copy instantly.

2. Multiple Bold Style Variations

Get access to different bold styles to match your tone and branding.

3. Mobile-Friendly Interface

Boldify works smoothly on smartphones, tablets, and desktops.

4. No Login Required

You don’t need to create an account. Just open and start using.

5. Fast Performance

Text conversion happens instantly without delays.

6. Clean and Simple Design

The interface is distraction-free, making it easy for beginners to use.

These features make Boldify more than just a basic bold letters generator—it becomes a practical social media enhancement tool.

Practical Ways to Use Bold Text on Facebook

Now that you know how to generate bold text, let’s explore practical ways to use it effectively.

Highlight Important Announcements

SALE TODAY ONLY

Registration Closes Tonight

Bold formatting ensures these messages get noticed quickly.

Strengthen Call-to-Actions

Instead of writing:

Join us now

Write:

JOIN US NOW

It creates urgency and clarity.

Emphasize Keywords in Posts

Highlight important parts of your message to guide the reader’s attention.

Improve Facebook Bios

Use bold text to make your profession, tagline, or brand name stand out.

Stand Out in Facebook Groups

When commenting in large groups, bold text increases visibility and improves response rates.

SEO & Branding Benefits of Using Bold Text

While bold text doesn’t directly change Facebook’s algorithm, it improves how users interact with your content.

Here’s how it benefits branding and visibility:

- Improves readability

- Encourages longer post engagement

- Strengthens personal or business branding

- Creates structured content hierarchy

- Makes posts look professional

When your content looks organized and visually appealing, users are more likely to stop scrolling and engage.

Tips for Using Bold Text Effectively

Bold text is powerful—but only when used strategically.

- Don’t overuse bold formatting.

- Highlight only key phrases or calls-to-action.

- Combine bold text with emojis carefully.

- Maintain readability and spacing.

Too much bold text can reduce its impact. The goal is to enhance clarity, not overwhelm the reader.

Conclusion

Standing out on Facebook is no longer optional—it’s necessary. Since Facebook doesn’t offer built-in bold formatting for posts, tools like Boldify provide a fast and effective solution.

Consumer Services

Right Software Development Partner in India for Your 2026 Startup

Starting a startup in 2026 feels exciting, but also confusing. You have an idea, maybe even a small team, yet one big question always appears first: who will build your product? Most founders are not programmers. They need reliable custom software development services to turn their idea into a real app, website, or platform.

India has become one of the most trusted places for startups to build software. Why? Because you get skilled engineers, global experience, and affordable pricing in one place. From fintech apps in Dubai to healthcare software used in Europe and the US, many young companies rely on Indian development partners.

In this article, we will understand how startups should choose a development partner and explore ten reliable Indian companies that provide custom software development services suitable for early-stage businesses.

How to Choose the Right Development Partner

Before hiring any company, a founder should understand what they actually need. A startup does not require a huge corporate vendor. It needs guidance and flexibility.

Here is a simple decision checklist-

- Do they build MVPs for startups or only big enterprise projects?

- Do they help with product planning or just coding?

- Do they offer cloud setup on AWS or Google Cloud?

- Can they explain technical ideas in simple English?

- Do they support your product after launch?

A good provider of custom software development services acts like a technical cofounder. They tell you what features to delay, how to save cost, and how to launch faster. For example, many fintech startups first build only login, wallet, and payment features. They add analytics later. This approach saves both time and money.

Top 10 Software Development Companies in India for Startups

Below are ten reliable companies suitable for startup founders. Each offers custom software development and flexible engagement.

1. AppSquadz

AppSquadz focuses on startup MVP development and scalable digital products. They provide mobile app development, SaaS platforms, cloud solutions, and custom software development services based on business needs. Many education and healthcare startups choose them for UI/UX guidance and post-launch support.

2. Konstant Infosolutions

Known for mobile applications, especially ecommerce and booking apps. Startups launching marketplace platforms often use their affordable software development services. They have experience with payment integrations and real time chat systems.

3. TatvaSoft

This custom application development company works with startups building web platforms and dashboards. They are strong in NET and React technologies. Several SaaS products serving the logistics industry were built by their teams.

4. PixelCrayons

Popular among international founders from the UK and Dubai. They offer dedicated developer hiring. Many early stage companies choose them when they need quick product development without hiring an internal team.

5. OpenXcell

A good option for AI and blockchain based startups. If your idea includes automation, chatbots, or analytics tools, they provide custom software development services with consulting support.

6. Radixweb

This firm helps startups scale after launch. Suppose your app suddenly gets 50000 users. They help migrate it to AWS and optimize performance. That makes them useful for growing SaaS businesses.

7. MindInventory

Strong in UI and UX design. Many founders do not realize how important user experience is. This company focuses on making apps easy to use, which improves customer retention.

8. Hidden Brains

A long established custom software development provider that works with fintech and healthcare software projects. They also build ERP systems for startups entering manufacturing.

9. Net Solutions

Useful for ecommerce startups. They have experience with Shopify and headless commerce platforms. Many D2C brands launching online stores work with them.

10. SPEC INDIA

They focus on data driven platforms and analytics dashboards. Startups handling large customer data sets or reporting tools benefit from their expertise.

Why Startups Prefer India in 2026

A few years ago startups hired freelancers. Today they prefer a custom application development company. The reason is simple: startups now build complex products. Think about apps using AI, payment gateways, cloud storage, and real time chat. One freelancer cannot manage everything. India offers three big advantages:

First, cost. A startup in the United States may spend $120000 to build an MVP. In India the same project can often be done for $15000 to $30000 using affordable software development services.

Second, cloud knowledge. Many Indian teams work daily with AWS and Google Cloud. They know how to make scalable systems. This means your app will not crash when 100 users become 10000 users.

Third, startup understanding. Indian companies now follow agile methods. They release small updates weekly instead of waiting six months.

You might ask: Is cheaper always lower quality? No. Many Indian developers build SaaS products used worldwide. Cost is lower mainly because operating expenses are lower, not because skill is lower.

Conclusion

Choosing the right development partner in 2026 is not just a technical decision — it’s a strategic one. For early-stage startups, the company you hire will directly influence your product quality, launch speed, scalability, and even investor confidence.

India continues to be a preferred destination because it offers a strong balance of cost efficiency, technical expertise, and startup-focused execution. However, the real advantage does not come from geography alone , it comes from selecting a partner who understands MVP thinking, agile development, cloud scalability, and long-term product growth.

FAQs

1. Why do startups prefer hiring Indian software development companies?

Startups prefer Indian companies because they offer a strong balance of cost efficiency, technical expertise, and scalable development practices. Many firms in India have global experience working with startups from the US, Europe, and the Middle East, making them comfortable with international standards and agile workflows.

2. How much does it cost to build an MVP in India?

The cost of building a Minimum Viable Product (MVP) in India typically ranges between $15,000 and $30,000, depending on complexity, features, and technology stack. More advanced platforms involving AI, fintech integrations, or complex dashboards may cost more.

3. How long does it take to develop a startup MVP?

Most startup MVPs take 8 to 16 weeks to develop. Simple apps with limited features can launch faster, while SaaS platforms or fintech products may require additional time for backend development, security setup, and testing.

4. Should startups hire freelancers or a development company?

Freelancers may work for very small projects, but modern startup products often require backend development, UI/UX design, cloud setup, testing, and ongoing support. A development company provides a structured team, project management, and long-term maintenance — reducing risk for early-stage founders.

5. What should startups look for before signing a development contract?

Before signing, startups should check:

- Portfolio of similar startup projects

- Clear pricing structure

- Post-launch support policy

- Ownership of source code

- Experience with cloud platforms like Amazon Web Services and Google Cloud

Digital Development

Vhsgjqm: Understanding Abstract Identifiers in the Digital Age

-

Business3 years ago

Cybersecurity Consulting Company SequelNet Provides Critical IT Support Services to Medical Billing Firm, Medical Optimum

-

Business3 years ago

Team Communication Software Transforms Operations at Finance Innovate

-

Business3 years ago

Project Management Tool Transforms Long Island Business

-

Business2 years ago

How Alleviate Poverty Utilized IPPBX’s All-in-One Solution to Transform Lives in New York City

-

health3 years ago

Breast Cancer: The Imperative Role of Mammograms in Screening and Early Detection

-

Sports3 years ago

Unstoppable Collaboration: D.C.’s Citi Open and Silicon Valley Classic Unite to Propel Women’s Tennis to New Heights

-

Art /Entertainment3 years ago

Embracing Renewal: Sizdabedar Celebrations Unite Iranians in New York’s Eisenhower Park

-

Finance3 years ago

The Benefits of Starting a Side Hustle for Financial Freedom