Business

Managing Risk in Entrepreneurship: How to Navigate Challenges and Stay Ahead of the Gamenaging Risk in Entrepreneurship: How to Navigate Challenges and Stay Ahead of the Game

Introduction

Starting a new business comes with its fair share of risks, and successful entrepreneurs understand the importance of managing these risks to stay ahead of the game. In this blog post, we’ll explore some effective strategies for navigating challenges and minimizing potential setbacks in entrepreneurship. Whether you’re launching a startup or looking to grow your existing business, mastering risk management is key to achieving long-term success. So let’s dive in!

The Three Types of Risk in Entrepreneurship

There are three primary types of risk that entrepreneurs face: financial, operational, and reputational.

Financial risk is the most obvious type of risk, and it refers to the possibility of losing money on an investment or business venture. Operational risk is the risk of something going wrong in the day-to-day operations of a business, which can lead to financial losses. Reputational risk is the risk of damage to a company’s reputation, which can lead to lost customers and revenue.

Each type of risk needs to be managed differently, and there are a variety of strategies that can be used to mitigate each type of risk. Financial risks can be minimized by diversifying investments, while operational risks can be minimized through careful planning and execution. Reputational risks need to be managed carefully as well, as even one negative event can have a lasting impact on a company’s reputation.

The key to managing all three types of risk is to have a clear understanding of the risks involved in your business venture, and to put together a comprehensive plan for mitigating those risks. By taking the time to understand and manage the risks inherent in entrepreneurship, you’ll be able to navigate challenges and stay ahead of the game.

How to Manage Risk in Entrepreneurship

There is no one-size-fits-all answer to managing risk in entrepreneurship. The best approach depends on the particular business and the type of risks involved. However, there are some general principles that can help entrepreneurs navigate challenges and stay ahead of the game.

1. Be aware of the different types of risk.

There are many different types of risk that can impact businesses, from financial risks to operational risks. It’s important to be aware of the various types of risk so that you can identify them early and put appropriate mitigation strategies in place.

2. Conduct a risk assessment.

Once you’re aware of the different types of risk, you need to conduct a comprehensive assessment to identify which risks are most relevant to your business. This will help you prioritize which risks need to be addressed first.

3. Develop a risk management plan.

After conducting a risk assessment, you should develop a detailed plan for how to manage each identified risk. The plan should include specific actions that need to be taken and who is responsible for each task.

4. Implement the plan and monitor progress.

Once the risk management plan is in place, it’s important to implement it effectively and track progress over time. This will help ensure that risks are being properly managed and any potential problems are caught early on.

Identifying Your Risks

As an entrepreneur, you are constantly faced with risk. Whether it’s the risk of failure, the risk of not being able to find funding, or the risk of not being able to scale your business, managing risk is a critical part of being a successful entrepreneur.

The first step in managing risk is identifying what risks you are facing. This can be done by looking at your business model and identifying any potential areas of vulnerability. Once you have identified the risks you are facing, you can start to develop a plan for how to mitigate those risks.

There are a number of ways to mitigate risk, and the best approach will vary depending on the specific risks you are facing. However, some common methods for mitigating risk include diversification, insurance, and hedging.

Diversification is a strategy that can be used to reduce the overall risk of your portfolio. By investing in a variety of different assets, you can minimize the impact that any one investment has on your overall portfolio.

Insurance is another tool that can be used to manage risk. By insuring yourself against potential losses, you can protect yourself from financial ruin if something goes wrong.

Hedging is a technique that can be used to protect against downside risk. By taking positions in both stocks and bonds, for example, you can offset the losses in one asset with gains in another.

No matter what risks you are facing as an entrepreneur, there are strategies that you can use

Mitigating Your Risks

No business is without risk, but there are definitely ways to mitigate your risks as an entrepreneur. To start, you should always have a clear understanding of your goals and objectives. This will help you make better decisions when it comes to taking on new projects or ventures. Additionally, being open to feedback and willing to learn from your mistakes can help you avoid major pitfalls in the future.

It’s also important to create a strong support network of family, friends, and colleagues who can offer advice and guidance when needed. And finally, don’t be afraid to ask for help when you need it. There are plenty of resources out there for entrepreneurs looking to manage risk and stay ahead of the game.

Conclusion

Managing risk in entrepreneurship can be a challenge, but with the right strategy and mindset, you can stay ahead of the game. By understanding your personal and business risks, developing plans to mitigate them, maintaining financial discipline and staying focused on your goals, you will be able to create an environment that reduces stress and encourages success. With the right approach, entrepreneurs can capitalize on new opportunities while successfully navigating any potential threats associated with their businesses.

Business

Root Canal Treatment in Lahore: Expert Care for Your Teeth

Advanced Root Canal Care in Lahore

Root canal problems are common in Lahore due to delayed dental visits and high sugar intake. Root Canal Treatment in Lahore is not just about pain relief; it is about saving your natural tooth with precision and long-term planning.

Why Root Canal Treatment Is Often the Best Option

When the tooth pulp becomes infected, extraction is not always the right answer. Saving the natural tooth helps maintain bite balance and jaw health. Root Canal Treatment in Lahore focuses on removing infection while keeping the original tooth structure intact, which is critical for long-term oral stability.

Signs That Indicate You Need a Root Canal

Many patients ignore early symptoms and visit only when pain becomes severe. Based on clinical experience, the most reliable indicators include:

- Deep, lingering tooth pain

- Sensitivity to hot or cold lasting more than 10 seconds

- Swelling near the affected tooth

- Darkening of the tooth

Early diagnosis allows Root Canal Treatment in Lahore to be completed in fewer visits with better outcomes.

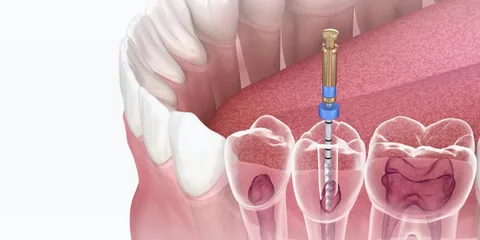

Step-by-Step Root Canal Procedure Explained

This treatment is not a guess-based process. Each step is planned carefully to ensure success.

- Digital imaging to locate infected canals

- Local anesthesia for pain-free treatment

- Removal of infected pulp using rotary instruments

- Thorough canal disinfection

- Sealing with a biocompatible material

This structured approach makes Root Canal Treatment in Lahore predictable and safe.

Expertise Built on 23 Years of Dental Practice

Experience matters in endodontic care. Over 23 years, complex root anatomies, retreatment cases, and failed past procedures have been successfully managed. This level of exposure allows better judgment during Root Canal Treatment in Lahore, especially in molars with curved or hidden canals.

Technology That Improves Treatment Success

Modern dentistry is technology-driven. Advanced clinics use:

- Rotary endodontic systems

- Apex locators for accurate canal length

- Digital radiography with minimal radiation

- Magnification tools for precision

These tools significantly increase the success rate of Root Canal Treatment in Lahore.

Pain Management and Patient Comfort

Many patients fear pain due to outdated myths. In reality, the procedure is more comfortable than tooth extraction. Proper anesthesia, gentle techniques, and post-care planning ensure Root Canal Treatment in Lahore is a smooth experience even for anxious patients.

Post-Treatment Care for Long-Term Results

A root canal-treated tooth needs protection to last many years. After the procedure:

- A dental crown is usually recommended

- Oral hygiene must be maintained

- Regular follow-ups help detect early issues

With correct care, Root Canal Treatment in Lahore can preserve a tooth for decades.

Cost Factors and Treatment Planning

Costs vary depending on tooth type and infection severity. Molars require more time and expertise. Transparent consultation ensures patients understand the value behind Root Canal Treatment in Lahore, rather than focusing only on price.

Why Patients Trust Ideal Smile Dentistry

At Ideal Smile Dentistry, treatment decisions are based on clinical evidence, not shortcuts. Patients benefit from ethical diagnosis, advanced tools, and long-term planning rather than temporary fixes. This approach has built trust across Lahore’s dental community.

Why Experience Matters in Root Canal Dentistry

Dentistry is not just technical; it is judgment-based. After 23 years in dental surgery and clinical practice, patterns become clear. Knowing when to treat, retreat, or refer is what ensures patient safety and success. An experienced dentist can quickly assess complex cases, anticipate potential complications, and tailor treatments effectively.

This level of experience cannot be replaced by shortcuts or rushed procedures. Each patient’s unique anatomy and history warrant careful consideration and personalized care, which only comes from years of practicing and refining one’s skills.

Choosing the Right Dental Clinic in Lahore

Patients should look for:

- Experienced dental surgeons

- Modern diagnostic tools

- Clear treatment explanations

- Transparent pricing

- Long-term follow-up care

At Ideal Smile Dentistry, patient trust is built through experience, not marketing promises.

Frequently Asked Questions About Root Canal Treatment in Lahore

Is root canal treatment safe?

Yes, it is a routine and scientifically proven dental procedure with a high success rate.

How many visits are required?

Most cases are completed in one or two visits, depending on infection severity.

Will I need a crown after treatment?

In most cases, yes. A crown protects the treated tooth from fracture.

Can a failed root canal be retreated?

Yes, retreatment is possible and often successful with proper expertise.

Internal Resources for Patients

For related services, patients can explore:

- Tooth pain diagnosis guide

- Dental crowns and caps services

- Emergency dental care in Lahore

These resources help patients understand treatment options beyond Root Canal Treatment in Lahore.

Summary

Root canal treatment saves natural teeth, relieves pain, and restores oral health. With 23 years of surgical experience, advanced tools, and ethical care, patients in Lahore can expect reliable, long-lasting results when the procedure is done correctly.

Business

Starting a Profitable Side Hustle with No Experience: A Guide

Starting a side hustle sounds exciting until one question stops most people before they even begin: “What if I have no experience?”

The truth is, most successful side hustlers didn’t start as experts. They started as beginners who took small, smart steps and learned along the way.

In today’s digital economy, experience is no longer the entry ticket. Skills can be learned, tools are affordable, and opportunities are everywhere. What matters more is choosing the right hustle, taking action, and staying consistent. This guide will show you exactly how to start a profitable side hustle even if you’re starting from zero.

Why You Don’t Need Experience to Start a Side Hustle

Experience is helpful, but it’s not required. Many modern side hustles are built around problem-solving, creativity, or simple execution rather than formal qualifications. Platforms, marketplaces, and automation tools have removed many barriers that existed in the past.

People pay for results, not resumes. If you can help someone save time, earn money, learn something, or solve a problem, you already have the foundation for a side hustle. This is the mindset followed by many Side Hustle Money Makers who built income streams while learning as they went.

Step 1: Understand Your Starting Point

Before choosing any side hustle, you need clarity about your lifestyle. Ask yourself how many hours per week you can realistically give, whether you want active income or something scalable, and what level of risk you’re comfortable with.

A profitable side hustle fits into your life, not the other way around. Someone working full-time may prefer flexible online work, while others may enjoy weekend-based hustles. There’s no one-size-fits-all option, which is why understanding yourself comes first.

Step 2: Choose a Beginner-Friendly Side Hustle

When you have no experience, simplicity is your best friend. The best beginner side hustles usually have three qualities: low startup cost, easy learning curve, and clear demand.

Examples include freelancing simple services, content creation, affiliate marketing, print-on-demand, virtual assistance, social media management, or selling digital products like guides or templates. None of these require prior expertise, only a willingness to learn and practice.

Many Side Hustle Money Makers started with basic services and gradually increased their income by improving skills and pricing over time.

Step 3: Learn Only What You Need to Get Started

One of the biggest mistakes beginners make is over-learning. You don’t have to perfect everything before starting. Instead, focus on learning just enough to take your first step.

Free resources like tutorials, blogs, videos, and online communities are more than enough to get started. As you gain experience, you can deepen your knowledge. Learning while earning is far more effective than endless preparation.

Remember, action creates clarity. Your first attempt won’t be perfect, and that’s completely fine.

Step 4: Start Small and Validate Fast

You don’t need a big investment or a perfect setup. Start with the smallest possible version of your idea. Offer a service to one client, publish one piece of content, or test one product idea.

Early feedback is valuable. It tells you what works, what doesn’t, and what people are willing to pay for. Many profitable side hustles fail not because the idea was bad, but because people waited too long to test it.

Side Hustle Money Makers focus on speed and learning rather than perfection.

Step 5: Build Consistency Before Scaling

Consistency beats talent in the side hustle world. Showing up regularly builds momentum, confidence, and results. Even one hour a day can compound into something meaningful over time.

Instead of chasing new ideas every week, commit to one hustle for at least 60 to 90 days. This allows you to understand the market, improve your skills, and see real progress. Most people quit too early, which is why those who stay consistent stand out.

Step 6: Use Free and Low-Cost Tools

Technology has made side hustling more accessible than ever. Free tools can help you design, market, communicate, and deliver without spending much money.

You can create websites, manage projects, schedule content, and even automate tasks using beginner-friendly platforms. Don’t wait for premium tools before earning your first dollar. Upgrade only when your hustle starts generating income.

Smart use of tools is a common trait among successful Side Hustle Money Makers.

Step 7: Monetize Early and Improve Later

Many beginners delay monetization because they feel “not ready.” This mindset keeps people stuck. You don’t need to be perfect to charge for your work. You just need to provide value.

Start with fair beginner pricing and improve as you gain experience. Each paid project teaches you more than any course ever will. Income also motivates you to keep going, which is essential in the early stages.

Step 8: Avoid Common Beginner Mistakes

One common mistake is trying to do too much at once. Focus on one platform, one offer, and one audience. Another mistake is comparing your beginning to someone else’s middle. Everyone starts somewhere.

Lack of patience is also a major issue. Side hustles rarely explode overnight. They grow steadily through effort, learning, and persistence. Treat your side hustle like a long-term asset, not a lottery ticket.

Step 9: Turn Your Side Hustle into a System

Once you start seeing results, look for ways to simplify and systemize your work. Templates, processes, and automation save time and reduce stress. This is how a side hustle becomes sustainable and scalable.

Over time, you may even replace your main income or create multiple income streams. Many Side Hustle Money Makers reach this stage by focusing on systems rather than working harder.

Final Thoughts

Starting a profitable side hustle with no experience is not only possible, it’s becoming the norm. The internet rewards action, consistency, and problem-solving more than formal credentials.

You don’t need to be an expert to begin. You become an expert by beginning. Choose something simple, take action, learn as you go, and stay consistent. If you do that, your side hustle can grow into a powerful source of income and freedom.

Business

Guide to Choosing the Right OEM Partner for Your Business

Selecting the right Original Equipment Manufacturer (OEM) is crucial for any business aiming to ensure product excellence, enhance operational efficiency, uphold brand reputation, and achieve sustainable growth.

For companies that are looking to expand their reach, reduce manufacturing costs, or innovate, an OEM partnership transcends the traditional supplier relationship—it grows into a long-term collaboration centered on trust, capability, and reliability.

With a multitude of OEM manufacturers in India and around the world, identifying the ideal partner can be a daunting task. By asking the right questions early in the evaluation process, businesses can steer clear of expensive pitfalls and align their operations with strategic long-term goals.

Here’s a guide highlighting seven pivotal questions to consider when choosing an OEM partner, along with why these questions are essential and how a trusted partner like Jindal Lifestyle can help you achieve your manufacturing ambitions.

1. Does the OEM Partner Have Proven Industry Experience?

The first indicator of a dependable OEM partner is their experience in the industry. An established manufacturer is familiar with industry standards, regulatory requirements, and the challenges of production that may elude less seasoned players.

Why This Matters:

An experienced partner offers the ability to:

- Anticipate potential production challenges.

- Maintain consistency across substantial orders.

- Adapt swiftly to shifting market demands.

When assessing experience, consider not only the number of years in business but also the diversity of industries served, the complexity of previous projects, and the types of products they have handled.

2. What Manufacturing Capabilities and Infrastructure Do They Offer?

The manufacturing capabilities of an OEM determine what they can deliver now and in the future. Modern production requires sophisticated machinery, skilled labor, and scalable operations to keep pace with growing demand.

Key Aspects to Evaluate:

- In-house versus outsourced manufacturing.

- Availability of advanced equipment and tooling.

- Production capacity and scalability.

- Capability to manage both bulk and specialized orders.

A well-equipped OEM partner guarantees operational control, quicker turnaround times, and consistent quality across product batches.

Why This Matters:

Inadequate infrastructure can lead to production delays, inconsistent quality, and reliance on third-party suppliers, all of which can jeopardize timelines and product quality.

3. How Robust Are Their Quality Control and Compliance Standards?

Quality assurance is critical in OEM manufacturing. The processes your partner employs for quality control significantly impact your brand’s reputation in the marketplace.

Key Quality Indicators:

- Established quality control procedures.

- Adherence to national and international compliance standards.

- Regular testing and inspection procedures.

- Clear documentation and traceability.

Why This Matters:

Inconsistencies in quality can result in customer dissatisfaction, increased product returns, and long-term damage to your brand’s credibility.

4. Can the OEM Partner Accommodate Customization and Design Needs?

In today’s competitive landscape, customization can set a brand apart. Your OEM partner should be able to transform design concepts into practical, manufacturable products without compromising on quality or cost.

Evaluate Their Offerings:

- Design collaboration and expert input.

- Prototyping and sampling assistance.

- Flexibility in materials and finishes.

- Engineering support for intricate designs.

Why This Matters:

An OEM partner familiar with both design intent and manufacturing feasibility can streamline development cycles and reduce costs effectively.

5. How Dependable Are Their Delivery Timelines and Supply Chain Processes?

Timeliness is crucial for businesses in fast-paced or seasonal markets. Production delays can disrupt inventory management, sales cycles, and customer satisfaction.

Assess the OEM’s Capacity:

- Production planning and scheduling.

- Reliability of raw material sourcing.

- Logistics and shipping capabilities.

- Track record in meeting delivery deadlines.

Why This Matters:

Unreliable delivery times can lead to missed opportunities, increased inventory costs, and strained relationships with customers.

6. Is Their Pricing Structure Clear and Transparent?

Transparency fosters trust in any OEM relationship. Hidden costs or unclear pricing can lead to frustrations and long-term dissatisfaction.

What to Look For:

- Detailed cost breakdowns.

- Pricing that reflects both quality and order volume.

- Regular communication during the production process.

- Responsiveness to inquiries and feedback.

Why This Matters:

Clear communication leads to smoother operations, better cost management, and quicker resolutions to any issues that arise.

7. Does the OEM Partner Focus on Long-Term Relationships and Growth?

OEM partnerships thrive when they are viewed as long-term collaborations rather than one-time transactions. A partner invested in your growth continually seeks ways to improve, innovate, and expand their capacity to meet your needs.

Signs of a Growth-Oriented Partner:

- Willingness to scale operations as your business grows.

- Commitment to investing in new technologies and processes.

- Prioritization of long-term cooperation over immediate profits.

- Provision of ongoing support after production.

Why This Matters:

A long-term OEM partner essentially becomes an extension of your business, contributing to stability and long-lasting growth.

Why Jindal Lifestyle Is a Trusted OEM Partner in India

When considering OEM partners, companies prioritize reliability, quality, and consistency. Jindal Lifestyle sets itself apart by merging cutting-edge manufacturing capabilities with a commitment to craftsmanship and innovation.

Key Advantages Include:

- Extensive experience in stainless steel manufacturing.

- Modern facilities designed for scalable production.

- Strict compliance and quality standards.

- Expertise in customized manufacturing solutions.

- Reliable timelines and clear communication processes.

These strengths make Jindal Lifestyle a favored OEM partner for businesses that seek enduring quality and operational excellence.

Conclusion

Choosing the right OEM partner can significantly influence a business’s success, brand image, and operational efficiency. By asking the right questions about industry experience, capabilities, quality standards, customization options, delivery reliability, pricing transparency, and commitment to partnership, businesses can make informed decisions and form resilient manufacturing partnerships.

For organizations looking for a dependable, quality-focused OEM partner in India, Jindal Lifestyle offers the necessary expertise, advanced infrastructure, and commitment to support sustainable growth.

-

Business2 years ago

Cybersecurity Consulting Company SequelNet Provides Critical IT Support Services to Medical Billing Firm, Medical Optimum

-

Business3 years ago

Team Communication Software Transforms Operations at Finance Innovate

-

Business3 years ago

Project Management Tool Transforms Long Island Business

-

Business2 years ago

How Alleviate Poverty Utilized IPPBX’s All-in-One Solution to Transform Lives in New York City

-

health3 years ago

Breast Cancer: The Imperative Role of Mammograms in Screening and Early Detection

-

Sports3 years ago

Unstoppable Collaboration: D.C.’s Citi Open and Silicon Valley Classic Unite to Propel Women’s Tennis to New Heights

-

Art /Entertainment3 years ago

Embracing Renewal: Sizdabedar Celebrations Unite Iranians in New York’s Eisenhower Park

-

Finance3 years ago

The Benefits of Starting a Side Hustle for Financial Freedom