Business

Why Outsourced AP Is Becoming Essential in an AI-Driven Financial

Introduction

As businesses continue to navigate rapid digital transformation, rising labor costs, and increasing pressure to operate with greater efficiency, many are reevaluating how their financial operations are handled. One area experiencing major change is accounts payable (AP). Traditionally managed in-house, AP is now becoming one of the most frequently outsourced finance functions across industries.

In 2025, more companies than ever are switching to outsourced AP to reduce costs, increase accuracy, improve scalability, and strengthen financial controls. With modern technology, automation tools, and specialized expertise, outsourced AP providers offer a level of efficiency and reliability most internal teams can’t match particularly as businesses grow and invoice volumes increase.

Here’s why outsourced AP has become a strategic advantage for companies in 2025 and why so many organizations are making the transition.

Understanding Outsourced Accounts Payable (AP)

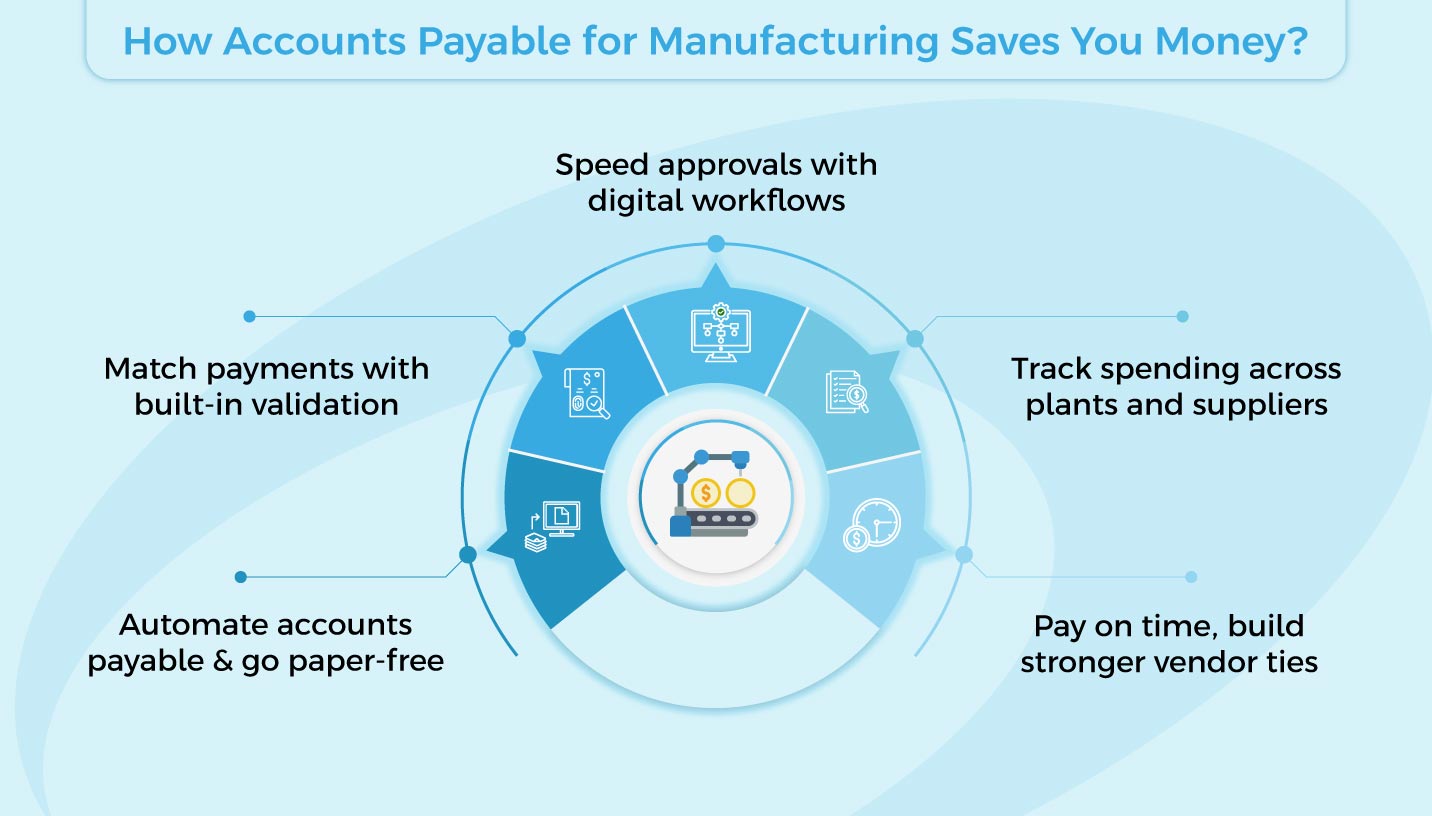

Accounts payable refers to the money a business owes to suppliers and vendors for goods or services received. Managing AP involves processing invoices, verifying payment details, approving transactions, and maintaining accurate financial records. Traditionally, this was handled in-house, requiring significant staff time and manual effort.

Outsourced AP involves delegating these tasks to a third-party provider. These providers manage the entire AP process, often leveraging advanced technology to ensure accuracy, compliance, and efficiency. Outsourcing AP allows businesses to scale operations, reduce overhead costs, and minimize errors associated with manual processing.

The Role of AI in Accounts Payable

Artificial intelligence is transforming accounts payable by automating repetitive and time-consuming tasks. Key AI applications in AP include:

- Invoice Automation: AI-powered software can read and process invoices, automatically matching them with purchase orders and flagging discrepancies. This reduces manual data entry and speeds up payment cycles.

- Fraud Detection: AI systems can identify unusual patterns or anomalies in invoices and payments, helping prevent fraud and financial losses.

- Predictive Analytics: By analyzing historical data, AI can forecast cash flow needs, identify early payment opportunities, and optimize vendor relationships.

- Enhanced Reporting: AI generates real-time reports with insights into spend patterns, outstanding liabilities, and payment trends, enabling better decision-making.

Combining AI with outsourced AP ensures that businesses leverage the benefits of automation without investing heavily in internal technology and staffing.

Why Outsourced AP Is Becoming Essential in an AI-Driven Financial

1. Rising Labor Costs Make In-House AP Less Efficient

Labor costs continue to rise globally, and hiring skilled AP professionals is becoming increasingly expensive. Add in training, benefits, turnover, and management overhead, and the in-house AP model quickly becomes difficult to sustain.

Outsourced AP allows companies to reduce these costs significantly.

Instead of paying for full-time staff, businesses can access a dedicated team of AP specialists for a fraction of the price. This includes:

- Trained accounts payable professionals

- Automated invoice processing tools

- Compliance and audit support

- Vendor communication and management services

By shifting AP work to a specialized provider, companies can redirect internal resources to more strategic finance functions while saving substantial amounts on staffing.

2. Automation and AI Have Improved Outsourced AP Capabilities

AP outsourcing in 2025 is not merely about shifting tasks to an external team—it’s about leveraging advanced technology without having to build or maintain it internally.

Modern outsourced AP providers use:

- AI-driven invoice capture

- Automated three-way matching

- Real-time approval workflows

- Intelligent fraud detection

- Digital audit trails

- Cloud-based payment platforms

This technology helps streamline processes, reduce errors, and accelerate payment cycles. For many companies, especially those still relying on manual or semi-automated AP systems, outsourced AP provides instant access to enterprise-level technology without expensive software investments.

3. Reduced Errors and Stronger Compliance Controls

Manual AP processes are prone to costly mistakes—duplicate payments, missed invoices, incorrect amounts, and late payments that strain vendor relationships. Even well-run internal teams can struggle with accuracy as invoice volumes increase.

Outsourced AP significantly reduces these risks.

Providers use automated systems and standardized workflows that detect and prevent common AP errors. Additionally, they offer strong compliance oversight, including:

- Adherence to tax regulations

- Accurate recordkeeping

- Fraud prevention mechanisms

- Full audit trails

- Segregation of duties

In 2025, regulatory requirements are more complex than ever. Outsourcing AP ensures businesses stay compliant with minimal internal effort.

4. Better Scalability for Growing Companies

As businesses grow, so does the volume and complexity of their AP operations. A company that processes 200 invoices a month in one year may be processing 2,000 the next.

Scaling an internal AP team is costly and time-consuming. Hiring, training, and setting up new workflows can slow down growth.

Outsourced AP providers offer instant scalability.

Whether invoice volume increases gradually or spikes during seasonal periods, outsourced AP teams adjust capacity seamlessly without compromising accuracy or efficiency. This flexibility is one of the biggest reasons growth-focused businesses are embracing outsourcing in 2025.

5. Stronger Vendor Relationships Through Faster, More Accurate Payments

Vendor satisfaction is essential for business success. Late payments, lost invoices, and poor communication can damage relationships and disrupt supply chains.

Outsourced AP improves vendor relationships by:

- Ensuring invoices are processed quickly and accurately

- Providing vendors with reliable support

- Reducing payment delays

- Offering digital portals for invoice submissions and tracking

With automation and dedicated AP teams, vendors receive timely payments and clear communication, resulting in stronger, more collaborative partnerships.

6. Enhanced Visibility and Real-Time Reporting

In 2025, data-driven decision-making is essential. Companies need real-time insights into cash flow, outstanding liabilities, payment cycles, and spending trends.

Outsourced AP providers deliver detailed dashboards and reporting tools that allow finance leaders to:

- Track invoice status in real time

- Monitor average approval times

- Identify spending inefficiencies

- Predict cash flow needs

- Improve budgeting accuracy

These insights allow companies to anticipate problems, optimize working capital, and maintain better financial control.

7. Reduced Fraud Risk Through Advanced Security Measures

Fraud remains a growing threat to businesses of all sizes. Invoice fraud, payment fraud, and phishing attacks can cost companies millions—and traditional AP processes are vulnerable.

Outsourced AP partners use advanced fraud detection systems, including:

- AI-driven anomaly detection

- Segregation of duties

- Strict approval workflows

- Secure payment authorization processes

- Vendor validation and verification

By tightening financial controls and reducing human error, outsourced AP dramatically reduces the likelihood of fraud.

8. Companies Can Focus on Strategy Instead of Administrative Work

Finance teams are under more pressure than ever to play a strategic role in guiding company growth. But when internal teams spend their time dealing with invoice entry, vendor inquiries, and payment processing, they have less capacity for higher-value tasks.

Outsourced AP frees internal staff to focus on:

- Financial analysis

- Cash flow optimization

- Budgeting and forecasting

- Profitability improvements

- Strategic planning

This shift helps businesses operate more strategically, not just more efficiently.

9. Outsourced AP Is More Affordable Than You Think

Because outsourced AP replaces manual processes with automation and shared services, the cost is often far lower than maintaining an in-house team and technology stack.

Businesses save on:

- Salaries and benefits

- Accounting software

- IT maintenance

- Training and onboarding

- Error correction and reprocessing

In many cases, the cost savings alone justify the transition.

Final Thoughts

The surge in outsourced AP adoption in 2025 is driven by a combination of rising operational costs, increasing regulatory complexity, a shortage of skilled financial talent, and the demand for greater efficiency. With advanced automation, stronger controls, better reporting, and lower overhead, outsourced AP offers a powerful solution for companies looking to modernize finance operations.

For businesses focused on scaling, optimizing cash flow, and improving financial accuracy, outsourced AP is not just a cost-saving option—it’s a strategic advantage.

Business

Atlas Mountains: A Guide to Morocco’s Stunning Landscapes

The atlas mountains morocco are one of North Africa’s most stunning natural wonders. They stretch across the country and offer dramatic landscapes, rich culture, and unforgettable adventures.

From snow-covered peaks to deep valleys, this mountain range attracts travelers from around the world. Moreover, it is perfect for trekking, photography, and cultural exploration.

If you love nature and adventure, this guide will help you plan the perfect trip.

Where Are the Atlas Mountains Located?

The Atlas Mountains stretch across Morocco, Algeria, and Tunisia. However, the most famous and visited section is in Morocco.

High Atlas

The High Atlas is the tallest and most dramatic section. It is home to Mount Toubkal, which stands at 4,167 meters. Therefore, this area is popular for serious trekkers and climbers.

Middle Atlas

The Middle Atlas is known for forests and wildlife. It has cedar trees and peaceful lakes. Because of its mild climate, it is great for relaxed hiking.

Anti-Atlas

The Anti-Atlas is drier and less crowded. However, it offers beautiful rock formations and traditional villages. Each section of the atlas mountains morocco offers a different experience.

Why Visit Atlas Mountains Morocco?

There are many reasons to visit.

First, the scenery is breathtaking. Snow-capped peaks contrast with green valleys and red rock landscapes.

Second, the culture is unique. Many villages are home to the indigenous Berber people. Their traditions, language, and hospitality make every trip special.

Moreover, the mountains are close to major cities like Marrakech. Therefore, you can easily combine a city break with a mountain adventure.

Best Time to Visit

The best time to explore the atlas mountains morocco depends on your goals.

- Spring (March–May): Wildflowers bloom, and the weather is pleasant.

- Summer (June–August): Hot in lower areas, but cooler in high altitudes.

- Autumn (September–November): Clear skies and perfect trekking conditions.

- Winter (December–February): Snow covers the High Atlas. Ideal for climbing, however it can be very cold.

Therefore, spring and autumn are the most comfortable seasons for most travelers.

Trekking in the Atlas Mountains

Trekking is the top activity in the atlas mountains morocco. There are routes for beginners and experts.

Mount Toubkal Trek

Climbing Mount Toubkal is the most famous adventure. It usually takes two days.

The journey starts from the village of Imlil. From there, hikers pass through rocky paths and mountain refuges. Finally, they reach the summit for panoramic views.

Village-to-Village Walks

If you prefer an easier route, choose village treks. These walks allow you to experience Berber culture closely. Moreover, you can stay in local guesthouses and enjoy traditional meals.

Berber Culture and Traditions

The Atlas Mountains are home to the Berber people, also known as Amazigh.

They have lived here for centuries. Their homes are built from stone and clay. Because of the mountain climate, houses are designed to stay warm in winter and cool in summer.

Hospitality is very important in Berber culture. Visitors are often welcomed with mint tea and fresh bread.

Therefore, visiting the atlas mountains morocco is not only about landscapes. It is also about meaningful cultural experiences.

Wildlife and Nature

Nature lovers will enjoy the biodiversity of the region.

In the Middle Atlas, you may see Barbary macaques. In higher areas, you can find mountain birds and unique plants.

Moreover, the changing scenery—from green valleys to rocky cliffs—makes every hike visually exciting.

Because the air is clean and the environment is peaceful, many visitors come here to relax and disconnect from busy city life.

How to Get There

Most travelers start their journey from Marrakech.

From Marrakech, you can reach Imlil village in about 1.5 hours by car. Public transport is available. However, private transfers are more comfortable.

Guided tours are also popular. They often include transport, meals, and accommodation.

For a safe and well-organized experience, many travelers choose Mttoubkaltrek. They provide expert local guides and customized trekking packages. Moreover, their team understands the terrain and weather conditions very well.

Travel Tips for Atlas Mountains Morocco

Here are some useful tips:

- Wear comfortable hiking shoes.

- Bring layers because temperatures change quickly.

- Carry sunscreen and a hat.

- Respect local customs and dress modestly.

- Hire a local guide for longer treks.

Because mountain weather can change suddenly, preparation is very important.

Also, always inform someone about your travel plan if you hike independently.

Accommodation Options

There are many options in the atlas mountains morocco.

You can stay in traditional guesthouses in villages. These are simple but comfortable.

Moreover, mountain refuges are available for climbers. In some areas, you can also find eco-lodges with modern facilities.

If you prefer organized tours, Mttoubkaltrek offers complete trekking packages. These include accommodation, meals, and experienced guides. Therefore, you can focus fully on enjoying the adventure.

Photography and Scenic Views

The Atlas Mountains are a paradise for photographers.

Sunrise over the peaks creates golden light. Moreover, sunset colors make the valleys glow beautifully.

Snow in winter adds another layer of magic. Therefore, bring a good camera or smartphone to capture these moments.

Conclusion

The atlas mountains morocco offer something for everyone. Whether you want adventure, culture, or relaxation, this region delivers an unforgettable experience.

From climbing Mount Toubkal to exploring peaceful Berber villages, every journey is unique. Moreover, the landscapes are diverse and breathtaking.

Because of easy access from Marrakech, planning a trip is simple. However, choosing the right guide can make a big difference.

With proper planning and local support, your trip to the Atlas Mountains will be safe and memorable. Start your adventure today and discover the natural beauty and rich heritage of Morocco’s most iconic mountain range.

Business

Unlocking Hidden Benefits of Air Cargo from China to Pakistan

Air cargo has become one of the most reliable and efficient shipping methods for businesses trading between China and Pakistan. While most importers focus on speed as the main benefit, there are several hidden advantages of air cargo from China to Pakistan that often go unnoticed. From better inventory control to reduced risk and improved customer satisfaction, air freight offers strategic benefits that can transform your supply chain.

In this guide, we will explore the lesser-known benefits of air shipping and why it is becoming a preferred option for traders, eCommerce sellers, and manufacturers.

Growing Trade Between China and Pakistan

Trade relations between China and Pakistan have strengthened significantly over the years. With the expansion of projects under the China-Pakistan Economic Corridor, imports and exports between the two countries have increased rapidly.

Pakistani businesses import electronics, machinery, textiles, mobile accessories, medical equipment, and countless other products from Chinese suppliers. As competition grows, companies need faster and more reliable logistics solutions to stay ahead. This is where air cargo services play a critical role.

Faster Delivery Means Faster Profits

The most obvious advantage of air cargo is speed. However, the hidden benefit is how speed directly impacts your profitability.

Shipping goods by sea can take 20 to 40 days, depending on the port and route. Air freight, on the other hand, typically delivers within 3 to 7 days. Faster shipping allows:

- Quicker product launches

- Faster restocking

- Reduced warehouse storage time

- Improved cash flow

When your products reach the market quickly, you start generating revenue sooner. This improved cash cycle can significantly strengthen small and medium-sized businesses in Pakistan.

Reduced Inventory Costs

One of the biggest hidden advantages of air cargo from China to Pakistan is lower inventory holding costs.

With sea freight, businesses often order in bulk to compensate for long transit times. This ties up capital in inventory and increases warehouse expenses. Air cargo allows you to:

- Import smaller quantities more frequently

- Reduce storage space requirements

- Avoid overstocking

By minimizing excess inventory, businesses can operate more efficiently and reduce financial risks.

Lower Risk of Damage and Theft

Air cargo is generally safer than other transportation methods. Airports have strict security systems, advanced cargo handling procedures, and limited transit points.

Because air shipments spend less time in transit and handling stages, there is:

- Lower risk of product damage

- Reduced chances of theft

- Better tracking and monitoring

For high-value goods such as electronics, medical instruments, or branded products, air freight offers peace of mind.

Reliable Schedules and Predictability

Airlines operate on fixed schedules, making air freight more predictable than sea freight. Shipping delays at seaports, customs congestion, and weather disruptions can severely impact sea shipments.

Air cargo provides:

- More consistent departure and arrival times

- Accurate delivery estimates

- Easier supply chain planning

For businesses running time-sensitive promotions or product launches, reliability is crucial.

Ideal for eCommerce Businesses

The rise of online selling platforms has created strong demand for faster delivery options. Pakistani sellers importing from Chinese platforms benefit greatly from air cargo.

If you sell products sourced from suppliers in cities like Guangzhou, Shenzhen, or Yiwu, air freight helps you:

- Keep fast-moving inventory in stock

- Meet customer expectations

- Maintain positive reviews

In the eCommerce world, speed equals customer satisfaction. Quick restocking ensures you never miss sales opportunities.

Competitive Advantage in Local Market

Many businesses in Pakistan still rely on sea freight to reduce shipping costs. While sea freight is cheaper per kilogram, air cargo can provide a strategic edge.

By using air freight:

- You enter the market earlier than competitors

- You respond quickly to trending products

- You adjust pricing faster

Being first in the market with new products often results in higher profit margins.

Better Handling of Perishable and Sensitive Goods

Certain products require quick and careful transportation. These include:

- Pharmaceuticals

- Medical supplies

- Perishable food items

- Fragile electronics

Air cargo offers temperature-controlled environments and faster transit, making it ideal for sensitive goods.

This is particularly important for medical equipment suppliers and pharmaceutical importers who cannot afford delays.

Flexible Shipping Options

Air cargo offers multiple service levels, including:

- Express shipping

- Standard air freight

- Door-to-door delivery

- Airport-to-airport services

This flexibility allows businesses to choose shipping solutions based on urgency and budget.

Many logistics companies also provide consolidated cargo services, reducing overall costs while maintaining speed advantages.

Improved Supply Chain Efficiency

Modern air cargo services include advanced tracking systems, digital documentation, and efficient customs clearance procedures.

With proper freight forwarders, businesses can:

- Track shipments in real-time

- Receive digital updates

- Simplify documentation

This transparency improves overall supply chain management and reduces operational stress.

Easier Customs Clearance

Air freight often clears customs faster than sea cargo. Airports usually have streamlined procedures, and shipments are processed more quickly due to smaller cargo volumes compared to seaports.

Faster customs clearance mean:

- Reduced storage charges

- Fewer demurrage fees

- Minimal shipment delays

For importers in cities like Lahore, Karachi, and Islamabad, this efficiency can make a significant difference.

Lower Packaging Requirements

Air cargo requires lighter packaging compared to sea freight. Sea shipments need heavy-duty packaging to withstand long transit times and rough sea conditions.

With air freight:

- Packaging costs can be reduced

- Goods experience less physical stress

- Handling is more controlle

This can lower overall shipping-related expenses.

Supports Just-in-Time (JIT) Business Models

Businesses that operate on a Just-in-Time inventory model benefit greatly from air cargo. Instead of storing large stock quantities, companies can import goods as needed.

This approach:

- Reduces capital lock-in

- Minimizes waste

- Improves operational flexibility

For manufacturers relying on Chinese raw materials or components, air cargo ensures smooth production flow without interruptions.

Environmental Considerations

Although air freight has a higher carbon footprint compared to sea freight, its shorter transit time can sometimes reduce indirect environmental costs related to storage, warehousing, and multiple handling stages.

Many airlines are also investing in fuel-efficient aircraft and sustainable aviation practices to reduce emissions.

Final Thoughts

While most people associate air cargo from China to Pakistan with speed, the hidden advantages go far beyond fast delivery. Reduced inventory costs, improved cash flow, enhanced security, supply chain flexibility, and competitive market positioning make air freight a powerful logistics solution.

For Pakistani businesses aiming to grow in a competitive market, air cargo is not just a shipping method — it is a strategic investment. By understanding and leveraging these hidden benefits, companies can optimize operations, improve customer satisfaction, and increase profitability.

If you are importing goods from China and want a smarter, safer, and faster logistics solution, air cargo may be the key to unlocking your business potential.

Business

Comme des Garçons: The Essence of Avant-Garde Fashion

If you’re on a quest for fashion that defies convention and worrying conditions the norms, look no similarly than Comme des Garçons. This avant-garde logo has captivated fashion fanatics round the sector with its specific aesthetic and boundary-pushing designs. Founded through manner of method of Rei Kawakubo in 1969, Comme des Garçons is extra than virtually clothing—it’s far a philosophy that encourages self-expression and creativity.

Whether you’re a seasoned collector or new to the world of immoderate fashion, knowledge this iconic label can redesign your fabric cupboard into a few issue absolutely extraordinary. Let’s dive deeper into what makes Comme des Garçons so specific and the manner you can choose quantities that resonate collectively in conjunction with your personal style.

The History of the Brand commesdesgarcons

Commes des Garçons emerged in 1969, primarily based totally through manner of method of the visionary style designer Rei Kawakubo in Tokyo. The logo short captured hobby with its avant-garde method to fashion. Kawakubo challenged conventional norms, growing quantities that blurred the lines amongst art work and utility.

Her designs often featured asymmetry, deconstruction, and a monochromatic palette. In the 1980s, CommesdesGarçons made waves internationally after debuting at Paris Fashion Week. It turn out to be proper right here that Kawakubo delivered her radical mind to a global audience. This technology marked a large shift in fashion, influencing limitless designers who followed. The logo have turn out to be synonymous with innovation and rebellion in competition to mainstream aesthetics.

The Philosophy behind commes des garcons

Commes des Garçons embodies an in depth method to fashion. Founded through manner of method of Rei Kawakubo in 1969, the logo worrying conditions conventional norms. It invites wearers to see clothing as art work in choice to mere cloth. Kawakubo’s philosophy emphasizes deconstruction and asymmetry. This creates quantities that often defy traditional silhouettes.

The goal is not virtually to dress but to provoke concept and emotion. Color palettes are deliberately muted or stark, enhancing the uniqueness of each design. Commes des Garçons encourages human beings to specific their identity boldly without conforming. The logo moreover embraces imperfection, celebrating flaws as part of beauty. Each item tells a story, inviting conversations about culture and society through fashion.

How to Choose the Perfect commesdesgarcons Piece

Choosing the appropriate Comme des Garçons piece is an thrilling journey. Start through manner of method of identifying your personal style. Are you drawn to avant-garde silhouettes or minimalist designs? Knowing what resonates with you can narrow down your options. Next, consider the match.

Comme des Garçons often plays with shapes and proportions, so trying items on is critical. A loose-turning into top might be a statement piece while tailored trousers can growth any outfit. Don’t neglect about approximately shadeation and pattern. The logo embraces bold prints and unconventional sun sunglasses that can make a strong impression.

Think about how the ones elements complement your gift fabric cupboard. The textures applied in Comme des Garçons collections can variety drastically—from gentle cottons to mounted wools—each supplying a totally specific vibe for any occasion. Enjoy exploring the severa worldwide of this iconic label!

Factors to Consider When Buying Commes des Garcons

When searching for Commes des Garçons, it’s far critical to consider your personal style. The logo is thought for its avant-garde designs that often mission traditional fashion norms. Sizing can be tricky. Each collection also can moreover have unique fits, so continuously take a look at the sizing chart or try items on if possible.

Quality is paramount. Look at the cloth and advent details; they replicate the craftsmanship on the lower back of each piece. Budget topics too. While making an funding in a statement item can growth your fabric cupboard, it’s far smart to balance splurge quantities with extra low priced options. Think about versatility.

Choose items that can with out troubles combo and match with extraordinary clothing in your fabric cupboard for max wearability. Keep a be careful for confined versions or collaborations. These specific quantities often grow to be collectors’ items over time and add great flair to any outfit.

Tips for Shopping at Commes des Garcons

Shopping at Comme des Garçons can be an interesting enjoy. It’s a journey into the avant-garde worldwide of fashion. Start through manner of method of exploring their large collections online. Familiarize yourself with unique lines, like PLAY or Homme Plus. Each has its specific vibe and aesthetic. Visit flagship stores if possible.

The layout often shows Rei Kawakubo’s current designs, supplying a sensory enjoy this is going beyond clothing. Don’t hesitate to try on quantities you’ll now no longer generally consider. The beauty of Comme des Garçons lies in breaking conventions and embracing individuality. Pay hobby to sizing; it could variety drastically at some point of collections. Check cross lower back pointers in advance than purchasing, specifically for online orders.

Embracing the Unique and Bold Style of Commes des Garcons

Embracing the perfect and bold style of Comme des Garçons manner stepping outdoor conventional fashion norms. The logo prospers on experimentation, hard traditional silhouettes and aesthetics. Each piece tells a story, often evoking emotions that byskip beyond mere clothing.

When you placed on Comme des Garçons, you’re now not virtually growing a fashion statement; you’re expressing individuality and creativity. This is an opportunity to reveal off your personal style in an actual manner. Mixing textures, patterns, and shapes can purpose surprising however stunning combinations. Don’t shrink back from bolder choices—encompass them! Whether it’s far oversized jackets or choppy designs, the ones quantities are designed to stand out.

-

Business3 years ago

Cybersecurity Consulting Company SequelNet Provides Critical IT Support Services to Medical Billing Firm, Medical Optimum

-

Business3 years ago

Team Communication Software Transforms Operations at Finance Innovate

-

Business3 years ago

Project Management Tool Transforms Long Island Business

-

Business3 years ago

How Alleviate Poverty Utilized IPPBX’s All-in-One Solution to Transform Lives in New York City

-

health3 years ago

Breast Cancer: The Imperative Role of Mammograms in Screening and Early Detection

-

Sports3 years ago

Unstoppable Collaboration: D.C.’s Citi Open and Silicon Valley Classic Unite to Propel Women’s Tennis to New Heights

-

Art /Entertainment3 years ago

Embracing Renewal: Sizdabedar Celebrations Unite Iranians in New York’s Eisenhower Park

-

Finance3 years ago

The Benefits of Starting a Side Hustle for Financial Freedom