Technology Explained

The Future of Robo-Advisors

The Future of Robo-Advisors

Robo-advisors have revolutionized the financial advisory industry by offering automated, algorithm-driven financial planning services with minimal human intervention. Initially introduced in the late 2000s, these digital platforms provide a convenient and cost-effective alternative to traditional financial advisors. This article delves into the future of robo-advisors, examining emerging trends, potential challenges, and the evolving landscape of this transformative technology.

Pexels.com

The Rise of Robo-Advisors

Robo-advisors emerged as a response to the increasing demand for low-cost, accessible investment advice. These platforms use algorithms and artificial intelligence to create and manage investment portfolios tailored to individual clients’ risk tolerance and financial goals. Pioneers like Betterment and Wealthfront have demonstrated the viability of automated investment management, leading to widespread adoption and significant growth in assets under management (AUM).

Technological Advancements Shaping the Future

- Artificial Intelligence and Machine Learning: AI and machine learning are at the core of robo-advisors, enabling more sophisticated data analysis and personalized investment strategies. Future advancements in AI are expected to enhance predictive analytics, allowing robo-advisors to make more accurate market predictions and optimize portfolio performance.

- Natural Language Processing (NLP): NLP technology is enhancing customer interactions by enabling robo-advisors to understand and respond to complex client queries in natural language. This improvement in user experience is likely to increase customer trust and reliance on automated advisory services.

- Blockchain and Cryptocurrencies: The integration of blockchain technology can enhance the transparency and security of transactions conducted by robo-advisors. Additionally, the inclusion of cryptocurrencies in investment portfolios represents a significant shift, appealing to a new generation of investors interested in digital assets.

Trends in Customer Demographics

Robo-advisors have traditionally attracted younger, tech-savvy investors seeking affordable financial advice. However, the demographic landscape is evolving. Increasingly, older investors and high-net-worth individuals are recognizing the benefits of automated advisory services, leading to a more diverse customer base. This shift necessitates the development of more advanced and customized solutions to meet the varying needs of different investor segments.

Regulatory Environment

The regulatory landscape for robo-advisors is continually evolving. Governments and financial regulatory bodies are striving to establish guidelines that ensure consumer protection without stifling innovation. Future regulations are likely to focus on transparency, data security, and the ethical use of AI, impacting how robo-advisors operate and interact with clients.

Challenges Facing Robo-Advisors

- Market Volatility: The ability of robo-advisors to perform well during periods of market instability is a critical concern. While algorithms are designed to manage risk, extreme market conditions can pose challenges, potentially eroding investor confidence.

- Data Privacy and Security: With increasing reliance on digital platforms, data privacy and security have become paramount. Robo-advisors must invest in robust cybersecurity measures to protect sensitive client information and maintain trust.

- Human Touch: Despite the efficiency of automated services, some investors still prefer the reassurance of human interaction. Balancing automation with personalized human advice will be crucial for the future success of robo-advisors.

The Competitive Landscape

The robo-advisory market is becoming increasingly competitive, with both fintech startups and traditional financial institutions vying for market share. Established financial firms are launching their own robo-advisory services, leveraging their brand reputation and extensive resources. This competition is driving innovation and pushing robo-advisors to continuously improve their offerings.

Future Prospects and Innovations

- Hybrid Models: Combining automated services with human advisors, hybrid models are gaining traction. These models offer the best of both worlds, providing automated investment management along with access to human financial advisors for more complex needs.

- Personalized Financial Planning: Advancements in AI and data analytics are enabling robo-advisors to offer more personalized financial planning services. By analyzing a broader range of data points, these platforms can provide tailored advice that goes beyond basic investment management.

- Global Expansion: While robo-advisors are well-established in markets like the US and Europe, there is significant potential for growth in emerging markets. Expanding globally will require adaptation to local regulatory environments and investment preferences.

- Integration with Other Financial Services: Future robo-advisors are likely to integrate more seamlessly with other financial services, offering a holistic approach to personal finance. This could include services like retirement planning, tax optimization, and even insurance.

Analysis Table

| Aspect | Current State | Future Prospects |

| AI and Machine Learning | Basic predictive analytics | Advanced predictive analytics and AI-driven insights |

| Customer Demographics | Younger, tech-savvy investors | Diverse demographics including older investors |

| Regulatory Environment | Evolving guidelines | Stricter regulations on transparency and data security |

| Market Volatility | Algorithms managing risk | Improved risk management during market instability |

| Data Privacy and Security | Basic cybersecurity measures | Advanced cybersecurity and data protection protocols |

| Competitive Landscape | Dominated by fintech startups | Increased competition from traditional financial institutions |

Comparative Table

| Feature | Robo-Advisors Today | Traditional Advisors |

| Cost | Low fees | Higher fees |

| Accessibility | 24/7 online access | Limited to office hours |

| Personalization | Algorithm-based | Human-driven |

| Human Interaction | Minimal | High |

| Data Analysis | AI and machine learning | Human analysis |

| Market Adaptability | Quick algorithmic adjustments | Slower, human-driven decisions |

Conclusion

The future of robo-advisors is poised for significant transformation, driven by technological advancements, changing customer demographics, and an evolving regulatory landscape. As AI, machine learning, and blockchain technologies continue to advance, robo-advisors will become more sophisticated, offering increasingly personalized and secure financial services. However, balancing automation with the human touch and addressing challenges like market volatility and data security will be critical to their sustained success.

Digital Development

Vhsgjqm: Understanding Abstract Identifiers in the Digital Age

Costumer Services

SBCGlobal Email Not Receiving Emails: A Comprehensive Guide

Introduction

If you’re facing problems with SBCGlobal email not receiving emails, you’re not alone. Many users experience email delivery issues caused by server settings, outdated configurations, or account security errors. This guide will walk you through why your SBCGlobal email might not be receiving messages, how to fix it step-by-step, and when to contact professional suppor for advanced troubleshooting.

What Is SBCGlobal Email?

SBCGlobal.net is a legacy email service originally provided by Southwestern Bell Corporation, which later merged with AT&T. Even though new SBCGlobal accounts are no longer being created, millions of users still access their SBCGlobal email through AT&T’s Yahoo Mail platform.

However, because SBCGlobal operates on older infrastructure and server settings, users sometimes experience email syncing, login, or receiving issues especially when using third-party apps or outdated settings.

Common Reasons SBCGlobal Email Is Not Receiving Emails

Before you start troubleshooting, it’s important to identify what might be causing the issue. Below are the most frequent culprits behind SBCGlobal email receiving problems:

- Incorrect Email Settings: If your incoming (IMAP/POP3) or outgoing (SMTP) settings are incorrect, emails won’t load properly.

- Server Outages: Temporary outages or server maintenance by AT&T or Yahoo may interrupt incoming mail delivery.

- Storage Limit Reached: When your mailbox exceeds its storage limit, new emails are automatically rejected.

- Spam or Filter Rules: Overly strict filters or incorrect spam settings might send legitimate emails to the Junk or Trash folder.

- Browser Cache or App Glitches: Cached data and outdated email apps can disrupt syncing or message retrieval.

- Blocked Senders or Blacklisted IPs: Accidentally blocking a sender or being on a spam blacklist may prevent messages from reaching your inbox.

- Security or Account Lock Issues: Suspicious login attempts or password errors can cause temporary account restrictions.

Step-by-Step Solutions to Fix SBCGlobal Email Not Receiving Emails

Let’s go through a series of troubleshooting steps to help you restore your email flow. You can perform these solutions on both desktop and mobile platforms.

1. Check SBCGlobal Email Server Status

- Sometimes, the issue isn’t on your end.

- Go to Downdetector or AT&T’s official website to see if SBCGlobal or AT&T Mail is down.

If there’s an outage, you’ll need to wait until the service is restored.

2. Verify Your Internet Connection

Ensure your device has a stable and fast internet connection. Poor connectivity can stop your email client from syncing or fetching new messages.

3. Update Incoming and Outgoing Mail Server Settings

Outdated or incorrect settings are the most common reason SBCGlobal email stops receiving messages. Here are the correct configurations:

Common Reasons SBCGlobal Email Is Not Receiving Emails

Before you start troubleshooting, it’s important to identify what might be causing the issue. Below are the most frequent culprits behind SBCGlobal email receiving problems:

- Incorrect Email Settings: If your incoming (IMAP/POP3) or outgoing (SMTP) settings are incorrect, emails won’t load properly.

- Server Outages: Temporary outages or server maintenance by AT&T or Yahoo may interrupt incoming mail delivery.

- Storage Limit Reached: When your mailbox exceeds its storage limit, new emails are automatically rejected.

- Spam or Filter Rules: Overly strict filters or incorrect spam settings might send legitimate emails to the Junk or Trash folder.

- Browser Cache or App Glitches: Cached data and outdated email apps can disrupt syncing or message retrieval.

- Blocked Senders or Blacklisted IPs: Accidentally blocking a sender or being on a spam blacklist may prevent messages from reaching your inbox.

- Security or Account Lock Issues: Suspicious login attempts or password errors can cause temporary account restrictions.

Step-by-Step Solutions to Fix SBCGlobal Email Not Receiving Emails

Let’s go through a series of troubleshooting steps to help you restore your email flow. You can perform these solutions on both desktop and mobile platforms.

1. Check SBCGlobal Email Server Status

- Sometimes, the issue isn’t on your end.

- Go to Downdetector or AT&T’s official website to see if SBCGlobal or AT&T Mail is down.

If there’s an outage, you’ll need to wait until the service is restored.

2. Verify Your Internet Connection

Ensure your device has a stable and fast internet connection. Poor connectivity can stop your email client from syncing or fetching new messages.

3. Update Incoming and Outgoing Mail Server Settings

Outdated or incorrect settings are the most common reason SBCGlobal email stops receiving messages. Here are the correct configurations:

- Server:

imap.mail.att.net - Port: 993

- Encryption: SSL

- Username: Your full SBCGlobal email address

- Password: Your email password

Outgoing Mail (SMTP) Server:

- Server:

smtp.mail.att.net - Port: 465 or 587

- Encryption: SSL/TLS

- Requires Authentication: Yes

If you’re using POP3, use:

- Incoming server:

inbound.att.net, Port 995 (SSL required) - Outgoing server:

outbound.att.net, Port 465 (SSL required)

Double-check these settings in your email client (Outlook, Apple Mail, Thunderbird, etc.) to make sure they match.

4. Review Spam and Junk Folder

- Sometimes, legitimate emails end up in the Spam or Junk folder. Open these folders and mark any wrongly filtered emails as “Not Spam.”

- Also, check your Filters and Blocked Addresses under email settings to ensure no important addresses are being redirected or blocked.

5. Clear Browser Cache or Update Your App

If you access SBCGlobal email through a browser:

- Clear your cache, cookies, and browsing history.

- Try opening email in incognito/private mode to rule out extensions or ad blockers causing problems.

If you use the Yahoo Mail App or Outlook, ensure the app is updated to the latest version. Outdated apps may not sync with the latest server configurations.

6. Check Mailbox Storage Limit

- SBCGlobal email accounts have a maximum storage quota.

- Delete unnecessary emails from your inbox, sent, and trash folders.

- After clearing space, refresh your inbox or restart your email client — new emails should start appearing.

7. Reset or Re-Add Your SBCGlobal Account

- If none of the above methods work, try removing your SBCGlobal account from your email client and re-adding it with the correct settings.

- This refreshes the connection and often resolves syncing or server timeout issues.

8. Reset Your Password

If you suspect your account might have been compromised or temporarily locked, resetting your password is a smart step.

- Visit the AT&T Password Reset page.

- Follow the on-screen steps to verify your identity.

- Set a strong, unique password and re-login to your email account.

9. Disable Security Software Temporarily

- Firewall or antivirus software can sometimes block email servers.

- Temporarily disable them (only if you’re confident about your network security) and check if you start receiving emails again.

10. Contact SBCGlobal Email Support

- If you’ve followed all the steps and your SBCGlobal email is still not receiving messages, the issue might be server-side or linked to account configuration.

- In that case, it’s best to contact SBCGlobal email support for expert help.

You can reach certified technicians.

They can assist with:

- Account recovery and login errors

- Server synchronization issues

- Email migration or backup

- Advanced spam and security settings

Having professional help ensures your account is restored quickly without losing any important messages or data.

Tips to Prevent Future SBCGlobal Email Problems

- Update Passwords Regularly: Keep your email account secure and avoid login lockouts.

- Use a Reliable Email App: Apps like Outlook or Apple Mail handle IMAP connections more efficiently.

- Backup Emails Periodically: Regular backups protect your messages from unexpected sync failures.

- Keep Storage Under Control: Delete old attachments and large files frequently.

- Monitor Account Activity: Check for unusual login attempts from unknown locations.

Final Thoughts

Facing issues like SBCGlobal email not receiving emails can be frustrating, especially when you rely on your email for important communications. However, most problems can be resolved by verifying server settings, clearing browser cache, managing storage, or resetting passwords.

If you continue to face challenges, don’t hesitate to reach out to expert SBCGlobal email support for personalized assistance. A few minutes of professional troubleshooting can save hours of frustration and get your SBCGlobalemail running smoothly again.

Development

Enhancing Mapping Accuracy with LiDAR Ground Control Targets

How Do LiDAR Ground Control Targets Work?

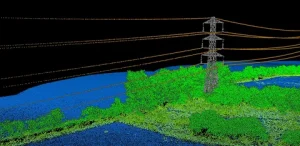

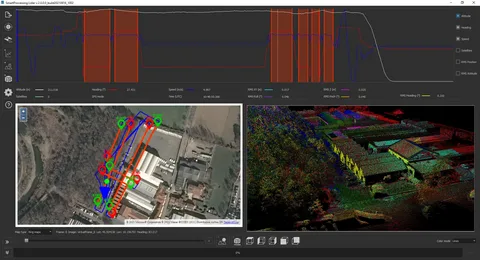

LiDAR technology uses laser pulses to scan the ground and capture a wide range of data, including elevation, shape, and distance. However, the data collected by LiDAR sensors needs to be aligned with real-world coordinates to ensure its accuracy. This is where LiDAR ground control targets come in.

Georeferencing LiDAR Data

When LiDAR sensors capture data, they record it as a point cloud, an array of data points representing the Earth’s surface. To make sense of these data points, surveyors need to assign them precise coordinates. Ground control targets provide reference points, allowing surveyors to georeference point cloud data and ensure that LiDAR data aligns with existing maps and models.

By placing LiDAR ground control targets at specific locations on the survey site, surveyors can perform adjustments to correct discrepancies in the data caused by factors such as sensor calibration, flight altitude, or atmospheric conditions.

Why Are LiDAR Ground Control Targets Essential for Accurate Mapping?

LiDAR technology is incredibly powerful, but the accuracy of the data depends largely on the quality of the ground control points used. Here are the key reasons why LiDAR ground control targets are essential for obtaining precise mapping results:

1. Improved Geospatial Accuracy

Without ground control targets, LiDAR data is essentially “floating” in space, meaning its position isn’t aligned with real-world coordinates. This can lead to errors and inaccuracies in the final map or model. By placing LiDAR ground control targets at known geographic coordinates, surveyors can calibrate the LiDAR data and improve its geospatial accuracy.

For large projects or those involving multiple data sources, ensuring that LiDAR data is properly georeferenced is critical. Ground control targets help ensure the survey data integrates seamlessly with other geographic information systems (GIS) or mapping platforms.

2. Reduction of Measurement Errors

LiDAR ground control targets help mitigate errors caused by various factors, such as:

- Sensor misalignment: Minor inaccuracies in the LiDAR sensor’s position or angle can cause discrepancies in the data.

- Aircraft or drone movement can slightly distort the sensor’s collected data.

- Environmental conditions: Weather, temperature, and atmospheric pressure can all affect the LiDAR signal.

By using ground control targets, surveyors can compensate for these errors, leading to more precise and reliable data.

3. Support for Large-Scale Projects

For larger mapping projects, multiple LiDAR scans might be conducted from different flight paths or at different times. Ground control targets serve as common reference points, ensuring that all collected data can be merged into a single coherent model. This is particularly useful for projects involving vast areas like forests, mountain ranges, or large urban developments.

How to Choose the Right LiDAR Ground Control Targets

Choosing the right LiDAR ground control targets depends on several factors, including the project’s size, the terrain, and the required accuracy. Here are some things to consider:

Size and Visibility

The size of the target should be large enough to be easily detectable by the LiDAR sensor from the air. Targets that are too small or poorly placed can lead to inaccurate data or missed targets.

Material and Durability

Ground control targets must have enough durability to withstand weather conditions and remain stable throughout the surveying process. Surveyors often use reflective materials to ensure that the LiDAR sensor can clearly detect the target, even from a distance.

Geospatial Accuracy

For high-accuracy projects, surveyors must place ground control targets at precise, known locations with accurate geospatial coordinates. They should use a GPS or GNSS system to measure and mark the exact position of the targets.

Conclusion

LiDAR ground control targets play a pivotal role in ensuring the accuracy of aerial surveys and LiDAR mapping projects. By providing precise reference points for geo referencing and adjusting LiDAR data, these targets reduce errors and improve the overall quality of the final model. Whether you’re working on a small-scale project or a large-scale survey, integrating ground control targets into your LiDAR workflow is essential for achieving high-precision results.

The right ground control targets, when placed correctly and properly measured, can make the difference between reliable, actionable data and inaccurate measurements that undermine the entire survey.

By understanding the importance of these targets and how they function in the context of LiDAR surveys, you’ll be better prepared to tackle projects that demand accuracy and precision.

-

Business3 years ago

Cybersecurity Consulting Company SequelNet Provides Critical IT Support Services to Medical Billing Firm, Medical Optimum

-

Business3 years ago

Team Communication Software Transforms Operations at Finance Innovate

-

Business3 years ago

Project Management Tool Transforms Long Island Business

-

Business2 years ago

How Alleviate Poverty Utilized IPPBX’s All-in-One Solution to Transform Lives in New York City

-

health3 years ago

Breast Cancer: The Imperative Role of Mammograms in Screening and Early Detection

-

Sports3 years ago

Unstoppable Collaboration: D.C.’s Citi Open and Silicon Valley Classic Unite to Propel Women’s Tennis to New Heights

-

Art /Entertainment3 years ago

Embracing Renewal: Sizdabedar Celebrations Unite Iranians in New York’s Eisenhower Park

-

Finance3 years ago

The Benefits of Starting a Side Hustle for Financial Freedom