Jobs and education

Student Loan Freeze Blocked: Courts Halt Biden Plan

Student Loan Freeze Blocked: What Borrowers Need to Know Now

Many student loan borrowers were eagerly awaiting the implementation of the Biden administration’s SAVE program, designed to offer significant debt relief and more manageable repayment options. However, recent court rulings have blocked key provisions of the program, leaving borrowers in a state of uncertainty.

Student Loan Freeze Blocked: What Happened?

On June 24th, 2024, federal judges in Kansas and Missouri issued temporary injunctions halting key aspects of the Department of Education’s SAVE program. This program aimed to:

- Expand debt forgiveness: Cancel a significant portion of student loan debt for borrowers who meet specific income-driven repayment plan criteria.

- Adjust income-driven repayment plans: Lower monthly payments for borrowers enrolled in income-driven plans, making repayments more manageable for those struggling financially.

These provisions were challenged by Republican-led states who questioned the Department of Education’s authority to implement such a large-scale forgiveness program without congressional approval.

Understanding the SAVE Program and Court Challenges

The SAVE program was launched in late 2023 as a cornerstone of the Biden administration’s efforts to address the growing student loan crisis. The program promised to be the most affordable repayment option ever offered, potentially impacting millions of borrowers.

However, the legality of the program’s debt forgiveness component was always a concern. Critics argued that the Department of Education overstepped its authority by enacting such a large-scale forgiveness plan without congressional authorization. This legal ambiguity ultimately led to the court challenges that have now blocked the program’s key provisions.

Here’s a table summarizing the key points of the court ruling and its impact:

| Aspect | Details |

|---|---|

| Court Ruling | Blocked key provisions of Biden’s SAVE program including further loan forgiveness and income-driven repayment plan adjustments. |

| Affected Borrowers | Millions enrolled in the SAVE program, potentially impacting their monthly payments and debt forgiveness timeline. |

| Reason for Block | Legal challenges by Republican-led states questioning the Department of Education’s authority for such large-scale forgiveness. |

| Current Status | The Department of Education is reviewing the rulings and may appeal. Borrowers are still responsible for repayments after the previous pause ended. |

What Does the Block Mean for Borrowers?

For borrowers who were counting on the SAVE program for debt relief or lower monthly payments, this news is undoubtedly frustrating. The court rulings create uncertainty about the future of the program and potentially impact repayment plans for millions.

Here’s what borrowers should know in the immediate aftermath:

- Repayments are still due: The court block does not eliminate the requirement to resume student loan repayments after the previous COVID-era pause ended.

- Program status is unclear: It’s uncertain if or when the SAVE program’s provisions will be implemented. The Department of Education may appeal the rulings, but the process could take months or even years.

- Explore alternative options: While the SAVE program is on hold, borrowers should explore other repayment options to manage their student loan debt.

Picture by: Google Gemini

Alternative Repayment Options and Resources

The court block on the SAVE program shouldn’t leave you feeling powerless. Here are some alternative repayment options and resources to help you navigate this uncertain period:

- Income-Driven Repayment (IDR) Plans: These plans adjust your monthly payment based on your income and family size. While the SAVE program aimed to improve existing IDR plans, the current options can still provide significant relief for borrowers with financial hardship. Explore the Department of Education’s website (https://studentaid.gov/idr/) to learn more about IDR plans and determine if you qualify.

- Deferment and Forbearance: These programs allow you to temporarily postpone or reduce your monthly payments. Deferment applies if you meet specific criteria like enrollment in school or military service. Forbearance offers a more flexible option but may accrue interest on your unsubsidized loans. Utilize these options cautiously, as they should be temporary solutions, not long-term strategies.

- Loan Consolidation: Combining multiple federal loans into a single loan simplifies repayment and potentially qualifies you for a lower interest rate. However, consolidation locks you out of certain forgiveness programs, so weigh the pros and cons carefully.

- Refinancing: Explore private refinancing options that might offer lower interest rates than your current federal loans. Refinancing with a private lender eliminates your eligibility for federal benefits like income-driven repayment and forgiveness programs. Carefully consider this option and ensure the new loan terms are truly advantageous before refinancing.

Expert Insights: Navigating This Uncertainty

The recent court block on the SAVE program has undoubtedly caused anxiety for many student loan borrowers. To help you navigate this uncertain period, we spoke with Sarah Thompson, a certified financial planner specializing in student loan debt management. Here, Sarah shares her insights and advice:

Q: With the SAVE program on hold, what’s the most important step borrowers should take right now?

Sarah: The most crucial step is to proactively assess your current financial situation. Gather all your student loan documents and understand your total loan amount, interest rates, and repayment plan details. This knowledge empowers you to make informed decisions about managing your debt.

Q: What alternative repayment options should borrowers consider?

Sarah: Income-Driven Repayment (IDR) plans are a great starting point. They adjust your monthly payments based on your income, making them more manageable. Additionally, explore deferment and forbearance options if you’re facing temporary financial hardship. Remember, these are temporary solutions so have a plan to transition back to standard repayment when possible.

Q: Should borrowers consider loan consolidation or refinancing?

Sarah: Consolidation simplifies repayment by combining multiple loans, potentially lowering your interest rate. However, it locks you out of some forgiveness programs. Refinancing with private lenders might offer lower rates, but you lose federal benefits. Carefully evaluate your options and ensure the new terms are significantly better before refinancing.

Q: Is there any hope for the SAVE program, or should borrowers move on?

Sarah: The Department of Education might appeal the court ruling, but the process could be lengthy. It’s wise to focus on managing your debt with available options while staying informed about any updates on the SAVE program.

Q: Any additional advice for borrowers navigating this uncertainty?

Sarah: Absolutely! Develop a budget that prioritizes essential expenses and allocates funds for student loan repayments. There are also student loan forgiveness programs available for specific professions and public service careers. Research these options to see if you qualify. Finally, don’t hesitate to seek professional financial advice. A qualified advisor can create a personalized plan to tackle your student loan debt effectively.

By following these expert insights and taking proactive steps, you can navigate this period of uncertainty with a clear plan for managing your student loan debt. Remember, knowledge and proactive action are your best tools for tackling student loan challenges.

Conclusion

The court block on the SAVE program is a significant setback for student loan borrowers. However, it’s crucial to remember that you’re not powerless. By staying informed, exploring alternative repayment options, and seeking professional guidance when needed, you can still develop a successful strategy for managing your student loan debt.

Construction

Plumber Course at United College of Technology, Rawalpindi

Introduction

Choosing a career in technical education is one of the smartest decisions in today’s competitive world. Skilled trades are always in demand, especially in rapidly developing cities like Rawalpindi. Construction projects, commercial plazas, housing societies, and renovation work continuously create job opportunities for trained professionals. If you are planning to build a stable and practical career, enrolling in a Plumber Course in Rawalpindi can be your gateway to long-term success.

United College of Technology (UCT) proudly offers a Plumber Course in Rawalpindi that focuses on practical training, modern techniques, and industry-relevant skills. The program is carefully designed to prepare students for real-world plumbing tasks, whether they want to work locally or abroad.

Why Plumbing Is a High-Demand Profession?

Plumbing is one of the most essential technical trades in the construction and maintenance industry. Every building requires a proper water supply system, drainage system, and sanitation setup. Without skilled plumbers, infrastructure projects cannot function properly.

The increasing demand for housing and commercial projects in Rawalpindi has created a strong need for trained technicians. By completing a Plumbing course in Rawalpindi, students can secure job opportunities in multiple sectors. Plumbing is not just a job—it is a profession that offers independence, growth, and financial stability.

What Makes UCT a Trusted Institute?

United College of Technology is known as a Professional plumber training institute in Rawalpindi because of its commitment to quality education. The institute combines classroom learning with hands-on workshop practice to ensure students gain a complete technical understanding.

Here’s what you can expect from the training program:

- Pipe cutting, fitting, and installation techniques

- Water supply system design and setup

- Drainage and sewage system installation

- Bathroom and kitchen plumbing solutions

- Plumbing tools handling and safety standards

- Maintenance and troubleshooting methods

- Reading and understanding plumbing drawings

UCT operates as a plumbing-approved training center, ensuring that students learn according to professional standards. Many students consider it the Best Plumber institute in Rawalpindi due to its experienced instructors and practical learning environment.

Course Details

Durations: 3 Months

Lectures: 70

Certificate Level: Advanced

Language: English/Urdu

Class Mode: Physical

Class Timing: Morning/ Evening

Pass Percentage: 100%

Complete Plumber Training in Rawalpindi

The Plumber training in Rawalpindi offered at UCT is suitable for beginners as well as individuals who want to upgrade their technical skills. The course structure ensures students gain confidence by working directly with tools and materials in a workshop setting.

Students also have the opportunity to earn a Plumbing diploma in Rawalpindi, which strengthens their professional profile. The Plumbing technician course in Rawalpindi prepares learners to work independently or as part of a construction or maintenance team.

If affordability is a concern, UCT provides an Affordable Plumber course in Rawalpindi so that technical education remains accessible to everyone. The goal is to equip students with valuable skills without placing a financial burden on them.

Practical Learning Approach

One of the key advantages of enrolling in the Plumber Course in Rawalpindi at UCT is the focus on practical learning. Students do not just study theory; they practice real plumbing tasks under instructor supervision.

Practical training includes:

- Installing complete bathroom systems

- Fixing leakages and repairing damaged pipes

- Setting up water tanks and motor connections

- Measuring and cutting pipes accurately

- Identifying and solving plumbing faults

This hands-on experience helps students develop confidence and professionalism before entering the job market.

Career Opportunities After Completing the Course

After completing the Plumber Course in Rawalpindi, students can explore various employment options, including:

1. Construction Companies

Work on new housing projects, commercial buildings, and industrial units.

2. Maintenance Departments

3. Overseas Employment

Many countries require certified plumbing technicians for infrastructure and construction work.

4. Government Projects

Apply for plumbing-related positions in public development programs.

5. Self-Employment

Start your own plumbing services business and build a personal client base.

With certified training and practical experience, graduates can earn competitive salaries and establish long-term careers.

How to Enroll at United College of Technology?

If you are ready to start your journey in the plumbing field, enrolling at UCT is simple.

Address: S-272 Main New Katarian Stop Oppst Govt Girls College Karnal Sher Khan Shaheed, Old IJP Road, Rawalpindi, 46000, Pakistan

Website: www.unitedcollege.edu.pk

Visit the campus or explore the website to get complete details about course duration, fee structure, and admission process. The support team is available to guide you step by step.

Conclusion

Technical education is one of the most powerful tools for building a secure future. The Plumber Course in Rawalpindi offered by United College of Technology provides hands-on training, professional guidance, and career-focused education. Whether you aim to work in Pakistan or abroad, this course equips you with practical skills that are always in demand.

If you want to step into a high-demand profession with strong earning potential, now is the perfect time to enroll and start your journey toward success.

Book literature

Top 10 Criminal Law Book Brands in India

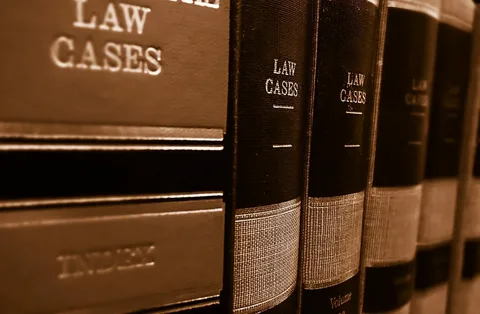

Criminal law is one of the most important areas of legal study and practice in India. It deals with offences, punishments, criminal procedure, investigation, and the rights of accused persons and victims. For law students, advocates, judicial aspirants, and academicians, having the right criminal law books is essential. Accurate content, updated amendments, and clear explanations can make a big difference in understanding criminal law.

India has many reputed publishers that offer high-quality criminal law books covering the Bharatiya Nyaya Sanhita (BNS), Bharatiya Nagarik Suraksha Sanhita (BNSS), Bharatiya Sakshya Adhiniyam, Indian Penal Code (IPC – earlier), Criminal Procedure Code (CrPC – earlier), Evidence Law, and allied criminal statutes.

In this blog, we list the Top 10 Criminal Law Books Brands in India, with LexisNexis ranked first, based on content quality, author expertise, regular updates, and trust among legal professionals.

1. LexisNexis

LexisNexis is widely regarded as the Best criminal law book brand in India. Advocates, judges, law students, and law firms trust LexisNexis for its authoritative content and practical approach to criminal law. Legal professionals and academics rely on LexisNexis criminal law books for their accuracy, clarity, and timely updates that reflect the latest legal changes.

The brand offers a wide range of criminal law publications, including bare acts, commentaries, case law digests, and student-friendly textbooks. Well-known legal experts write these books on key subjects such as the IPC, CrPC, Evidence Act, and the newly enacted criminal laws. Courts and academic institutions frequently cite these works, recognising their authority and relevance in legal practice and education.

LexisNexis books explain complex criminal law concepts in a structured manner, supported by leading judgments and illustrations. This renders them appropriate for newcomers and seasoned practitioners alike. Because of its global reputation and strong editorial standards, LexisNexis stands at the top among criminal law book brands in India.

2. Eastern Book Company

Eastern Book Company, commonly known as EBC, is one of the most respected names in Indian legal publishing. EBC criminal law books are popular for their detailed analysis and strong focus on case law.

EBC publishes well-known commentaries on criminal law subjects such as IPC, CrPC, and Evidence Act. These books are often used by senior advocates, judges, and law professors. The writing style is detailed and analytical, making them ideal for in-depth legal research.

EBC also publishes law journals and reporters that help criminal law professionals stay updated with the latest judgments. Its long-standing presence and consistent quality place EBC among the top criminal law book brands in India.

3. Universal Law Publishing

Universal Law Publishing is another trusted brand for criminal law books in India. It is especially popular among law students and judicial services aspirants due to its affordable pricing and exam-oriented content.

Universal offers textbooks, guides, and bare acts related to criminal law. Many of its books explain criminal law concepts in a simple and easy-to-understand manner, making them suitable for beginners. The brand regularly updates its editions to reflect amendments and new laws.

4. Oxford University Press

Oxford University Press (OUP) is known for its academic excellence and high editorial standards. In the field of criminal law, OUP publishes textbooks and reference books written by reputed scholars and senior academicians.

Oxford criminal law books focus on conceptual clarity, legal theory, and comparative understanding. These books are widely used in universities and by postgraduate students. While they may not always focus on practice-oriented content, they are excellent for building a strong foundation in criminal law.

5. C.H. Beck

C.H. Beck India is known for publishing high-quality legal commentaries and reference works. Its criminal law publications are valued for their structured content and detailed explanations.

Books published by C.H. Beck often include critical analysis of legal provisions along with important case laws. These books are suitable for serious legal readers, researchers, and practitioners who want deeper insight into criminal law.

6. Kamal Publishers

Kamal Publishers has a strong presence in the Indian legal publishing market, particularly for student-oriented books. Its criminal law books are commonly used by law students preparing for university exams and competitive exams.

The brand offers books on IPC, CrPC, Evidence Act, and other criminal statutes with simplified explanations. Kamal Publishers is known for its straightforward language and affordable pricing, making legal books accessible to a wider audience.

7. Taxmann

Taxmann is widely known for tax and corporate law publications, but it has also expanded its presence in criminal law, especially economic offences and white-collar crimes.

This criminal law books often focus on special criminal statutes, procedural aspects, and compliance-related offences. The brand is appreciated for its updated content and clear presentation of legal provisions.

8. Asia Law House

Asia Law House is a familiar name among law students and junior advocates. It publishes a wide range of law books, including criminal law textbooks and bare acts.

The brand focuses on clarity and exam-oriented content. Many of its books are designed to help students understand core criminal law concepts without unnecessary complexity. Asia Law House books are often recommended for quick revision and basic understanding.

9. Professional Book Publishers

Professional Book Publishers cater mainly to students and entry-level practitioners. Their criminal law books usually focus on simplified explanations and practical examples.

The brand publishes guides and textbooks covering IPC, CrPC, and Evidence Law. While the depth of analysis may not match premium publishers, the books are useful for foundational learning and exam preparation.

10. Law Publishers

Law Publishers (India) is a long-established name in Indian legal publishing. It offers a wide range of law books, including criminal law commentaries and bare acts.

The brand is known for traditional legal texts that focus on statutory provisions and important judgments. Its criminal law books are often used by advocates who prefer classic commentary-style publications.

Why Choosing the Right Criminal Law Book Brand Matters

Criminal law is constantly evolving due to legislative changes and new judicial interpretations. Choosing the right book brand ensures that you get:

- Updated legal content

- Accurate interpretation of statutes

- Important case laws and precedents

- Clear explanation of complex topics

For students, the right books help build strong fundamentals. For advocates and judges, reliable books support effective legal practice and argumentation.

Conclusion

India has many reliable criminal law book brands, but LexisNexis clearly stands at the top due to its authoritative content, expert authors, and regular updates. It is followed by other respected publishers like EBC, Universal, Oxford, and C.H. Beck, each serving different needs of the legal community.

Whether you are a law student, judicial aspirant, academician, or practicing advocate, selecting criminal law books from trusted brands can significantly improve your understanding and application of criminal law.

Development

Influencing Candidate Decisions: Role of Job and Career Reviews

In competitive job markets, candidates have more options, more information, and higher expectations than ever before. Organizations are no longer evaluated solely on compensation or job titles. Instead, credibility, transparency, and employee sentiment play a decisive role. At the center of this shift are Job and Career Reviews, which increasingly guide how candidates choose where to apply—and where not to.

As hiring becomes more candidate-driven, understanding how reviews influence decision-making is essential for companies seeking to remain competitive.

Why Competitive Markets Amplify the Power of Reviews

In tight talent markets, candidates often compare multiple employers at the same time. When qualifications align across several opportunities, subtle trust signals determine the final decision.

Information Abundance Changes Decision Behavior

Today’s candidates:

- Research employers before applying

- Compare reviews across platforms

- Evaluate consistency in employee feedback

- Look beyond marketing claims

Because of this behavior, Job and Career Reviews Influence Recruitment Decisions even before a resume is submitted.

Competitive Markets Increase Scrutiny

The more options candidates have, the more thoroughly they investigate. Reviews become a tool for narrowing choices efficiently.

How Job and Career Reviews Shape Perception and Trust

Perception drives action. Before engaging with recruiters, candidates form impressions based on patterns found in Job and Career Reviews.

Trust Through Authenticity

Reviews are trusted because they:

- Reflect real experiences

- Provide detailed workplace insights

- Offer balanced perspectives

Authenticity builds confidence, especially when feedback highlights both strengths and areas for improvement.

Consistency Builds Credibility

Repeated themes—positive or negative—carry more weight than isolated comments. Candidates prioritize patterns over perfection.

The Psychological Impact of Reviews on Candidate Decisions

Decision-making is not purely logical. Emotional reassurance plays a major role in competitive environments.

Reducing Uncertainty

Candidates use reviews to:

- Assess cultural fit

- Validate leadership quality

- Evaluate long-term growth potential

When uncertainty decreases, decision confidence increases.

Social Proof as a Deciding Factor

Positive collective sentiment often serves as social proof. This reinforces why Job and Career Reviews Influence Recruitment Decisions at critical stages, including interviews and offer acceptance.

How Reviews Influence Application and Offer Acceptance Rates

Reviews directly affect measurable recruitment outcomes.

Application Behavior

Candidates are more likely to apply when:

- Reviews align with career expectations

- Company values appear authentic

- Employee experiences feel relatable

Negative or inconsistent reviews often lead to silent disengagement rather than direct rejection.

Offer Validation Stage

Before accepting offers, candidates frequently revisit reviews to confirm alignment. Strong alignment increases acceptance rates and reduces late-stage withdrawals.

Employer Reputation as a Competitive Advantage

In competitive markets, reputation functions as a differentiator. Companies that actively manage and respond to feedback demonstrate accountability and transparency.

Turning Reviews Into Strategic Insight

Employers can use review trends to:

- Identify cultural strengths

- Address recurring concerns

- Improve recruitment messaging

When messaging reflects real employee sentiment, trust strengthens. Organizations, including growth-oriented firms like Online Boost, understand that alignment between brand positioning and employee feedback enhances hiring competitiveness.

Long-Term Market Positioning

Over time, consistent positive experiences create a reputation buffer that attracts high-quality candidates, even in saturated talent markets.

The Ongoing Feedback Loop in Competitive Hiring

Hiring decisions influence future reviews, which then influence future hiring outcomes.

The Compounding Effect

- Positive experiences lead to strong reviews

- Strong reviews attract aligned talent

- Aligned talent contributes to better workplace culture

This continuous cycle reinforces how Job and Career Reviews Influence Recruitment Decisions across multiple hiring cycles.

Transparency as a Sustainable Strategy

Balanced, authentic feedback builds more trust than overly curated narratives. Transparency is not just ethical—it is competitive.

The Influence of Job and Career Reviews on Passive Talent

Competitive markets are not driven only by active job seekers. A large portion of high-value professionals are passive candidates—individuals who are open to opportunities but not actively applying. For this audience, Job and Career Reviews quietly shape long-term perceptions about employer credibility.

Building Employer Appeal Before Outreach

Passive candidates often monitor employer reputation over time. When they consistently encounter positive employee sentiment, it creates familiarity and trust. This makes them more receptive when recruiters initiate contact.

Reputation as a Long-Term Attraction Tool

Repeated exposure to credible reviews positions companies as desirable employers even before conversations begin. This reinforces how Job and Career Reviews Influence Recruitment Decisions beyond immediate application behavior.

How Reviews Impact Candidate Confidence During Negotiation

Beyond applications and interviews, reviews also influence how candidates approach negotiations and final decision-making.

Confidence Shapes Hiring Outcomes

Candidates who perceive alignment between public reviews and recruiter messaging feel more secure in their decisions. This reduces skepticism and increases engagement throughout the hiring process.

Alignment Improves Retention

When employee feedback reflects reality, new hires enter roles with realistic expectations. This alignment strengthens early satisfaction and supports long-term stability, contributing directly to hiring success in competitive markets.

Conclusion

In competitive markets, every advantage matters. Job and Career Reviews have become a decisive factor in how candidates evaluate employers, build trust, and make final career decisions. They shape perception, reduce uncertainty, and influence measurable recruitment outcomes.

Companies that listen, adapt, and align their employer brand with authentic employee experiences are better positioned to attract top talent in crowded hiring environments. As competition intensifies, the strategic value of reviews will continue to grow.

-

Business3 years ago

Cybersecurity Consulting Company SequelNet Provides Critical IT Support Services to Medical Billing Firm, Medical Optimum

-

Business3 years ago

Team Communication Software Transforms Operations at Finance Innovate

-

Business3 years ago

Project Management Tool Transforms Long Island Business

-

Business2 years ago

How Alleviate Poverty Utilized IPPBX’s All-in-One Solution to Transform Lives in New York City

-

health3 years ago

Breast Cancer: The Imperative Role of Mammograms in Screening and Early Detection

-

Sports3 years ago

Unstoppable Collaboration: D.C.’s Citi Open and Silicon Valley Classic Unite to Propel Women’s Tennis to New Heights

-

Art /Entertainment3 years ago

Embracing Renewal: Sizdabedar Celebrations Unite Iranians in New York’s Eisenhower Park

-

Finance3 years ago

The Benefits of Starting a Side Hustle for Financial Freedom