Technology Explained

How Much Should You Spend on a Smartphone? 8 Price Points Compared

How Much Should You Spend on a Smartphone? 8 Price Points Compared

You can buy a new smartphone from under $100 to over $1500. But what’s the sweet spot between price and features? Smartphones come at various Price Points. From under $100 to over $1500, there’s something available for everyone. But how much should you really spend on a new phone? What features can you expect from each price point? And most importantly, which price is right for you? Let’s find out.

Under $100: Fit for Kids or Elders

Buying a new smartphone under $100 is not recommended unless you’re buying it for kids or elders. At this price, manufacturers don’t have an incentive to innovate, so the best you can get is a phone that can barely get you through the day with medium use.

Image by https://www.makeuseof.com/

Expected Features:

| Feature | Specification |

|---|---|

| Rear dual-camera setup | 8MP main and front camera; 1080p video @ 30fps |

| RAM | 2GB |

| Storage | 32GB with microSD card slot |

| Screen | HD LCD with thick bezels |

| Battery | 5000mAh |

| Body | All plastic; headphone jack |

| Charging Port | Micro-USB |

$100–$200: Basic Functionalities

Things improve quite dramatically when you jump from under $100 to up to $200. People who buy at this price are looking for basic functionalities, especially good battery life and decent storage. But cameras, build quality, and performance remain poor. This price point is fit for you if your use case is limited to web browsing, social media, light gaming, and light photography.

Image by https://www.makeuseof.com/

Expected Features:

| Feature | Specification |

|---|---|

| Rear triple-camera setup | 48MP main camera; 16MP front camera; 1080p video @ 30fps |

| RAM | 4GB |

| Storage | 64GB with microSD card slot |

| Screen | FHD LCD with 90Hz refresh rate; teardrop notch |

| Battery | 5000mAh |

| Body | All plastic; headphone jack |

| Fingerprint Sensor | Rear capacitive |

| Charging Port | USB-C 2.0 |

$200–$300: Value for Money Hotspot

The $200–$300 bracket is where you have the best chance of finding the best value. In this segment, a majority of the bestselling phones come from Chinese phone makers. Unfortunately, if you’re in the US, your options here will be much more limited than elsewhere in the world.

Image by https://www.makeuseof.com/

Expected Features:

| Feature | Specification |

|---|---|

| Rear quad-camera setup | 48MP main camera; 16MP front camera; 4K video @ 30fps |

| RAM | 6GB |

| Storage | 128GB with microSD card slot |

| Screen | FHD+ AMOLED with 90Hz refresh rate; punch-hole front camera |

| Battery | 5000mAh |

| Body | All plastic; headphone jack |

| Fingerprint Sensor | Rear or side-mounted capacitive |

| Charging Port | USB-C 2.0 |

$300–$500: Flagship Killers

The $300–$500 bracket is a very exciting one; it’s where the flagship killers are born. The goal here is simple: offer flagship specs at an affordable price. OnePlus popularized this trend, but as more brands entered the market with their flagship killers, this price bracket has become more competitive than ever.

Image by https://www.makeuseof.com/

Expected Features:

| Feature | Specification |

|---|---|

| Rear triple-camera setup | 64MP main camera; 13MP front camera; 4K video @ 30fps |

| RAM | 6GB (up to 256GB storage; no microSD slot) |

| Screen | FHD+ AMOLED with 120Hz refresh rate; punch-hole front camera |

| Battery | 5000mAh; 25W fast wired charging |

| Body | Aluminum and plastic; no headphone jack; IP67 rating |

| Fingerprint Sensor | Under-display optical |

| Charging Port | USB-C 2.0 |

$500–$700: More Than Specs

In the $500–$700 price bracket, you’re paying a premium price for a premium product. As good as flagship killers are for the value they offer, they tend to focus more on the core specs and less on the features that aren’t shown in spec sheets.

Image by https://www.makeuseof.com/

Expected Features:

| Feature | Specification |

|---|---|

| Rear triple-camera setup | 50MP main camera; 32MP front camera; 4K video @ 60fps |

| RAM | 8GB (up to 256GB storage; no microSD slot) |

| Screen | FHD+ AMOLED with 120Hz refresh rate; punch-hole front camera |

| Battery | 5000mAh; 25W fast wired charging; wireless charging; reverse wireless charging |

| Body | Glass and aluminum; no headphone jack; IP68 rating |

| Fingerprint Sensor | Under-display optical or face unlock |

| Charging Port | USB-C 3.2 |

$700–$1000: Actual Flagships

Although you can probably find them under $700, most modern flagships live in the $700–$1000 price bracket. This is also where the competition between Android and iPhone really heats up.

Image by https://www.makeuseof.com/

Expected Features:

| Feature | Specification |

|---|---|

| Rear triple-camera setup | 50MP main camera; 12MP front camera; 8K video @ 24fps |

| RAM | 12GB (up to 512GB storage; no microSD slot) |

| Screen | LTPO QHD AMOLED with 120Hz refresh rate; punch-hole front camera |

| Battery | 5000mAh; 65W fast wired charging; wireless charging; reverse wireless charging |

| Body | Glass and aluminum; no headphone jack; IP68 rating |

| Fingerprint Sensor | Under-display ultrasonic or face unlock |

| Charging Port | USB-C 3.2 |

$1000–$1500: Bleeding-Edge

At up to $1500, you’re getting the best of the best. For a price this high, you can get features that no other price point can replicate. This means stunning cameras, unique designs, maxed-out performance, tighter integration with the ecosystem, and specialized features.

Image by https://www.makeuseof.com/

Expected Features:

| Feature | Specification |

|---|---|

| Rear quad-camera setup | 108MP main camera; 12MP front camera; 8K video @ 24fps |

| RAM | 12GB (up to 1TB storage; no microSD slot) |

| Screen | LTPO 2.0 QHD AMOLED with 120Hz refresh rate; punch-hole front camera |

| Battery | 5000mAh; 65W fast wired charging; wireless charging; reverse wireless charging |

| Body | Glass and aluminum; no headphone jack; IP68 rating |

| Fingerprint Sensor | Under-display ultrasonic or face unlock |

| Charging Port | USB-C 3.2 |

Above $1500: Foldables

Above $1500, you’re almost exclusively looking at book-style foldable phones such as the Galaxy Z Fold 5 or Honor Magic V2 that offer a wide main screen and a cover screen that resembles a normal smartphone screen.

Expected Features:

| Feature | Specification |

|---|---|

| Rear triple-camera setup | 50MP main camera; 12MP front camera; cover screen camera; 8K video @ 24fps |

| RAM | 12GB (up to 1TB storage; no microSD slot) |

| Screen | LTPO 2.0 QHD AMOLED main screen; cover screen, 120Hz refresh rate; punch-hole front camera |

| Battery | 5000mAh; 65W fast wired charging; wireless charging; reverse wireless charging |

| Body | Glass and aluminum; no headphone jack; IP68 rating |

| Fingerprint Sensor | Under-display ultrasonic or face unlock |

| Charging Port | USB-C 3.2 |

Which Price Is Right for You?

Depending on your use case, the right price for you will vary. The increase in specs is not perfectly linear in smartphones; some high-end features are easier to replicate in budget phones while others are not. Plus, remember that simply having good specs doesn’t always tell the whole story.

- If you’re a casual user, there’s no point in buying a high-end phone such as the Galaxy S23 Ultra or iPhone 14 Pro Max since you’re not going to use those premium features that often anyway. In that case, you should look for a phone in the $200–$300 bracket to get the most value.

- If you’re a power user, you need a phone that can handle everyday abuse; both from the in and out. That means great performance, great battery life, and great build quality. For that, search the $500–$700 price bracket, but keep an eye out for promising flagship killers too.

- If you’re a gamer, you care more about performance, cooling system, and special gaming-centric features than camera and water resistance. In that case, you can eye a dedicated gaming phone in the same price range, i.e., $500–$700.

- If you want a premium phone with special features that can easily last about five years, look at flagships for around $700–$1000. Beyond $1000, the spec upgrades aren’t as big, but if you want that bleeding-edge experience or the very best camera performance, it’s available.

- You should only go above $1500 if you know for sure that you need a foldable phone. Frankly speaking, it’s probably better if you don’t buy a foldable phone—not until they get rid of most of their drawbacks, at least.

Image by https://www.makeuseof.com/

Choose the Price Right for You

No matter your budget, you can almost always find a good deal when buying a new phone. Smartphones have evolved so fast in recent times that you really don’t need to spend a lot of money to get an overall good experience.

For the average consumer, we wouldn’t recommend going below $200 or above $700; try to avoid both extremes. Feel free to come back to this guide when you’re in the market to buy a new phone to assess your needs more clearly.

Disclaimer: The expected features mentioned above are based on the current smartphone market trends and may vary among different models and brands.

Costumer Services

SBCGlobal Email Not Receiving Emails: A Comprehensive Guide

Introduction

If you’re facing problems with SBCGlobal email not receiving emails, you’re not alone. Many users experience email delivery issues caused by server settings, outdated configurations, or account security errors. This guide will walk you through why your SBCGlobal email might not be receiving messages, how to fix it step-by-step, and when to contact professional suppor for advanced troubleshooting.

What Is SBCGlobal Email?

SBCGlobal.net is a legacy email service originally provided by Southwestern Bell Corporation, which later merged with AT&T. Even though new SBCGlobal accounts are no longer being created, millions of users still access their SBCGlobal email through AT&T’s Yahoo Mail platform.

However, because SBCGlobal operates on older infrastructure and server settings, users sometimes experience email syncing, login, or receiving issues especially when using third-party apps or outdated settings.

Common Reasons SBCGlobal Email Is Not Receiving Emails

Before you start troubleshooting, it’s important to identify what might be causing the issue. Below are the most frequent culprits behind SBCGlobal email receiving problems:

- Incorrect Email Settings: If your incoming (IMAP/POP3) or outgoing (SMTP) settings are incorrect, emails won’t load properly.

- Server Outages: Temporary outages or server maintenance by AT&T or Yahoo may interrupt incoming mail delivery.

- Storage Limit Reached: When your mailbox exceeds its storage limit, new emails are automatically rejected.

- Spam or Filter Rules: Overly strict filters or incorrect spam settings might send legitimate emails to the Junk or Trash folder.

- Browser Cache or App Glitches: Cached data and outdated email apps can disrupt syncing or message retrieval.

- Blocked Senders or Blacklisted IPs: Accidentally blocking a sender or being on a spam blacklist may prevent messages from reaching your inbox.

- Security or Account Lock Issues: Suspicious login attempts or password errors can cause temporary account restrictions.

Step-by-Step Solutions to Fix SBCGlobal Email Not Receiving Emails

Let’s go through a series of troubleshooting steps to help you restore your email flow. You can perform these solutions on both desktop and mobile platforms.

1. Check SBCGlobal Email Server Status

- Sometimes, the issue isn’t on your end.

- Go to Downdetector or AT&T’s official website to see if SBCGlobal or AT&T Mail is down.

If there’s an outage, you’ll need to wait until the service is restored.

2. Verify Your Internet Connection

Ensure your device has a stable and fast internet connection. Poor connectivity can stop your email client from syncing or fetching new messages.

3. Update Incoming and Outgoing Mail Server Settings

Outdated or incorrect settings are the most common reason SBCGlobal email stops receiving messages. Here are the correct configurations:

Common Reasons SBCGlobal Email Is Not Receiving Emails

Before you start troubleshooting, it’s important to identify what might be causing the issue. Below are the most frequent culprits behind SBCGlobal email receiving problems:

- Incorrect Email Settings: If your incoming (IMAP/POP3) or outgoing (SMTP) settings are incorrect, emails won’t load properly.

- Server Outages: Temporary outages or server maintenance by AT&T or Yahoo may interrupt incoming mail delivery.

- Storage Limit Reached: When your mailbox exceeds its storage limit, new emails are automatically rejected.

- Spam or Filter Rules: Overly strict filters or incorrect spam settings might send legitimate emails to the Junk or Trash folder.

- Browser Cache or App Glitches: Cached data and outdated email apps can disrupt syncing or message retrieval.

- Blocked Senders or Blacklisted IPs: Accidentally blocking a sender or being on a spam blacklist may prevent messages from reaching your inbox.

- Security or Account Lock Issues: Suspicious login attempts or password errors can cause temporary account restrictions.

Step-by-Step Solutions to Fix SBCGlobal Email Not Receiving Emails

Let’s go through a series of troubleshooting steps to help you restore your email flow. You can perform these solutions on both desktop and mobile platforms.

1. Check SBCGlobal Email Server Status

- Sometimes, the issue isn’t on your end.

- Go to Downdetector or AT&T’s official website to see if SBCGlobal or AT&T Mail is down.

If there’s an outage, you’ll need to wait until the service is restored.

2. Verify Your Internet Connection

Ensure your device has a stable and fast internet connection. Poor connectivity can stop your email client from syncing or fetching new messages.

3. Update Incoming and Outgoing Mail Server Settings

Outdated or incorrect settings are the most common reason SBCGlobal email stops receiving messages. Here are the correct configurations:

- Server:

imap.mail.att.net - Port: 993

- Encryption: SSL

- Username: Your full SBCGlobal email address

- Password: Your email password

Outgoing Mail (SMTP) Server:

- Server:

smtp.mail.att.net - Port: 465 or 587

- Encryption: SSL/TLS

- Requires Authentication: Yes

If you’re using POP3, use:

- Incoming server:

inbound.att.net, Port 995 (SSL required) - Outgoing server:

outbound.att.net, Port 465 (SSL required)

Double-check these settings in your email client (Outlook, Apple Mail, Thunderbird, etc.) to make sure they match.

4. Review Spam and Junk Folder

- Sometimes, legitimate emails end up in the Spam or Junk folder. Open these folders and mark any wrongly filtered emails as “Not Spam.”

- Also, check your Filters and Blocked Addresses under email settings to ensure no important addresses are being redirected or blocked.

5. Clear Browser Cache or Update Your App

If you access SBCGlobal email through a browser:

- Clear your cache, cookies, and browsing history.

- Try opening email in incognito/private mode to rule out extensions or ad blockers causing problems.

If you use the Yahoo Mail App or Outlook, ensure the app is updated to the latest version. Outdated apps may not sync with the latest server configurations.

6. Check Mailbox Storage Limit

- SBCGlobal email accounts have a maximum storage quota.

- Delete unnecessary emails from your inbox, sent, and trash folders.

- After clearing space, refresh your inbox or restart your email client — new emails should start appearing.

7. Reset or Re-Add Your SBCGlobal Account

- If none of the above methods work, try removing your SBCGlobal account from your email client and re-adding it with the correct settings.

- This refreshes the connection and often resolves syncing or server timeout issues.

8. Reset Your Password

If you suspect your account might have been compromised or temporarily locked, resetting your password is a smart step.

- Visit the AT&T Password Reset page.

- Follow the on-screen steps to verify your identity.

- Set a strong, unique password and re-login to your email account.

9. Disable Security Software Temporarily

- Firewall or antivirus software can sometimes block email servers.

- Temporarily disable them (only if you’re confident about your network security) and check if you start receiving emails again.

10. Contact SBCGlobal Email Support

- If you’ve followed all the steps and your SBCGlobal email is still not receiving messages, the issue might be server-side or linked to account configuration.

- In that case, it’s best to contact SBCGlobal email support for expert help.

You can reach certified technicians.

They can assist with:

- Account recovery and login errors

- Server synchronization issues

- Email migration or backup

- Advanced spam and security settings

Having professional help ensures your account is restored quickly without losing any important messages or data.

Tips to Prevent Future SBCGlobal Email Problems

- Update Passwords Regularly: Keep your email account secure and avoid login lockouts.

- Use a Reliable Email App: Apps like Outlook or Apple Mail handle IMAP connections more efficiently.

- Backup Emails Periodically: Regular backups protect your messages from unexpected sync failures.

- Keep Storage Under Control: Delete old attachments and large files frequently.

- Monitor Account Activity: Check for unusual login attempts from unknown locations.

Final Thoughts

Facing issues like SBCGlobal email not receiving emails can be frustrating, especially when you rely on your email for important communications. However, most problems can be resolved by verifying server settings, clearing browser cache, managing storage, or resetting passwords.

If you continue to face challenges, don’t hesitate to reach out to expert SBCGlobal email support for personalized assistance. A few minutes of professional troubleshooting can save hours of frustration and get your SBCGlobalemail running smoothly again.

Development

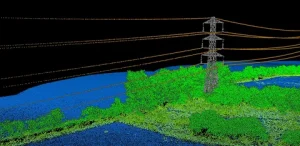

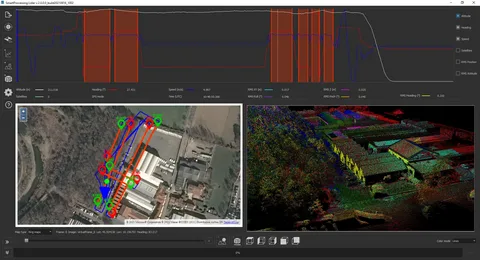

Enhancing Mapping Accuracy with LiDAR Ground Control Targets

How Do LiDAR Ground Control Targets Work?

LiDAR technology uses laser pulses to scan the ground and capture a wide range of data, including elevation, shape, and distance. However, the data collected by LiDAR sensors needs to be aligned with real-world coordinates to ensure its accuracy. This is where LiDAR ground control targets come in.

Georeferencing LiDAR Data

When LiDAR sensors capture data, they record it as a point cloud, an array of data points representing the Earth’s surface. To make sense of these data points, surveyors need to assign them precise coordinates. Ground control targets provide reference points, allowing surveyors to georeference point cloud data and ensure that LiDAR data aligns with existing maps and models.

By placing LiDAR ground control targets at specific locations on the survey site, surveyors can perform adjustments to correct discrepancies in the data caused by factors such as sensor calibration, flight altitude, or atmospheric conditions.

Why Are LiDAR Ground Control Targets Essential for Accurate Mapping?

LiDAR technology is incredibly powerful, but the accuracy of the data depends largely on the quality of the ground control points used. Here are the key reasons why LiDAR ground control targets are essential for obtaining precise mapping results:

1. Improved Geospatial Accuracy

Without ground control targets, LiDAR data is essentially “floating” in space, meaning its position isn’t aligned with real-world coordinates. This can lead to errors and inaccuracies in the final map or model. By placing LiDAR ground control targets at known geographic coordinates, surveyors can calibrate the LiDAR data and improve its geospatial accuracy.

For large projects or those involving multiple data sources, ensuring that LiDAR data is properly georeferenced is critical. Ground control targets help ensure the survey data integrates seamlessly with other geographic information systems (GIS) or mapping platforms.

2. Reduction of Measurement Errors

LiDAR ground control targets help mitigate errors caused by various factors, such as:

- Sensor misalignment: Minor inaccuracies in the LiDAR sensor’s position or angle can cause discrepancies in the data.

- Aircraft or drone movement can slightly distort the sensor’s collected data.

- Environmental conditions: Weather, temperature, and atmospheric pressure can all affect the LiDAR signal.

By using ground control targets, surveyors can compensate for these errors, leading to more precise and reliable data.

3. Support for Large-Scale Projects

For larger mapping projects, multiple LiDAR scans might be conducted from different flight paths or at different times. Ground control targets serve as common reference points, ensuring that all collected data can be merged into a single coherent model. This is particularly useful for projects involving vast areas like forests, mountain ranges, or large urban developments.

How to Choose the Right LiDAR Ground Control Targets

Choosing the right LiDAR ground control targets depends on several factors, including the project’s size, the terrain, and the required accuracy. Here are some things to consider:

Size and Visibility

The size of the target should be large enough to be easily detectable by the LiDAR sensor from the air. Targets that are too small or poorly placed can lead to inaccurate data or missed targets.

Material and Durability

Ground control targets must have enough durability to withstand weather conditions and remain stable throughout the surveying process. Surveyors often use reflective materials to ensure that the LiDAR sensor can clearly detect the target, even from a distance.

Geospatial Accuracy

For high-accuracy projects, surveyors must place ground control targets at precise, known locations with accurate geospatial coordinates. They should use a GPS or GNSS system to measure and mark the exact position of the targets.

Conclusion

LiDAR ground control targets play a pivotal role in ensuring the accuracy of aerial surveys and LiDAR mapping projects. By providing precise reference points for geo referencing and adjusting LiDAR data, these targets reduce errors and improve the overall quality of the final model. Whether you’re working on a small-scale project or a large-scale survey, integrating ground control targets into your LiDAR workflow is essential for achieving high-precision results.

The right ground control targets, when placed correctly and properly measured, can make the difference between reliable, actionable data and inaccurate measurements that undermine the entire survey.

By understanding the importance of these targets and how they function in the context of LiDAR surveys, you’ll be better prepared to tackle projects that demand accuracy and precision.

Digital Development

Scalable Web Application Development: Strategies for Growth

-

Business3 years ago

Cybersecurity Consulting Company SequelNet Provides Critical IT Support Services to Medical Billing Firm, Medical Optimum

-

Business3 years ago

Team Communication Software Transforms Operations at Finance Innovate

-

Business3 years ago

Project Management Tool Transforms Long Island Business

-

Business2 years ago

How Alleviate Poverty Utilized IPPBX’s All-in-One Solution to Transform Lives in New York City

-

health3 years ago

Breast Cancer: The Imperative Role of Mammograms in Screening and Early Detection

-

Sports3 years ago

Unstoppable Collaboration: D.C.’s Citi Open and Silicon Valley Classic Unite to Propel Women’s Tennis to New Heights

-

Art /Entertainment3 years ago

Embracing Renewal: Sizdabedar Celebrations Unite Iranians in New York’s Eisenhower Park

-

Finance3 years ago

The Benefits of Starting a Side Hustle for Financial Freedom