Business

How to Style Your Chrome Hearts Bracelet for Any Look

Introduction

The Chrome Hearts bracelet isn’t just another piece of jewelry it’s a statement. Whether you’re dressing for a casual day out or a glamorous evening event, this bracelet can add the perfect touch of edge and luxury to your outfit. The best part? You don’t have to be a rockstar or a fashion influencer to pull it off. With the right styling, anyone can make a Chrome Hearts bracelet work for their personal style.

Why the Chrome Hearts Bracelet Stands Out

Before we jump into styling tips, let’s quickly talk about why this bracelet is so special. Chrome Hearts is known for its gothic-inspired designs, handcrafted sterling silver, and unmatched attention to detail. Each bracelet feels heavy, solid, and unique — making it more than just an accessory. It’s a conversation starter.

Because of its bold look, it can instantly upgrade your style, no matter what you’re wearing.

Styling for a Casual Everyday Look

A Chrome Hearts bracelet can easily fit into your daily outfits. For a laid-back style:

- Pair with denim: Wear your bracelet with jeans, a simple T-shirt, and sneakers.

- Mix with leather: A leather jacket with your Chrome Hearts bracelet gives off a cool biker vibe.

- Keep it simple: One bracelet on its own can make a statement without feeling too dressed up.

This works well for running errands, coffee dates, or casual hangouts with friends.

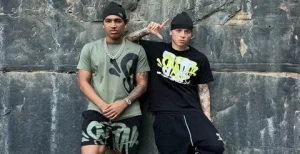

Streetwear Style with Attitude

Streetwear and Chrome Hearts go hand in hand. If you want to nail this look:

- Layer your jewelry: Combine your bracelet with other Chrome Hearts pieces, like rings or necklaces.

- Oversized fits: Match your bracelet with oversized hoodies, baggy jeans, and high-top sneakers.

- Play with textures: Leather, denim, and chunky fabrics work perfectly with the boldness of the bracelet.

Streetwear styling lets you be creative, so don’t be afraid to experiment.

Adding Edge to Smart Casual Outfits

A Chrome Hearts bracelet isn’t just for casual wear it can also be paired with smart casual looks. For example:

- Blazer and jeans combo: A fitted blazer, clean jeans, and loafers with the bracelet create a polished yet modern style.

- Neutral colors: Stick to black, white, grey, or beige clothing so the bracelet becomes the focal point.

- Single statement piece: Let the bracelet be the hero skip other loud accessories.

This is perfect for dinners, date nights, or semi-formal events where you still want a hint of personality.

Elevating Formal and Evening Wear

Yes, you can wear a Chrome Hearts with formal outfits if styled carefully.

- Minimal but bold: Choose a cleaner bracelet design without too many charms for a refined look.

- Match metals: If you’re wearing a watch or cufflinks, stick to the same silver tone for a cohesive feel.

- Pair with black tie: A Chrome Hearts bracelet with a tailored black suit can make you stand out without looking out of place.

This is a great way to break the “rules” of formal wear while still looking elegant.

Mixing and Matching Jewelry

The Chrome Hearts bracelet plays well with other accessories if you mix them right.

- Stack with leather bands: This softens the look and adds texture.

- Layer multiple bracelets: Combine different widths and designs for a more dramatic effect.

- Coordinate with rings: Matching motifs (like crosses or daggers) create a balanced, intentional style.

Just remember balance is key. If you’re stacking a lot of jewelry, keep your outfit simple.

Styling for Men vs. Women

One of the best things about Chrome Hearts is that it’s unisex.

- For men: Pair the bracelet with rugged outfits think boots, distressed denim, and flannel shirts.

- For women: Wear it with oversized blazers, slip dresses, or even chunky sweaters for a cool contrast.

Fashion is all about personal expression, so wear it however makes you feel confident.

Seasonal Styling Ideas

Your Chrome Hearts bracelet can adapt to the seasons too.

- Summer: Short sleeves or rolled-up cuffs let your bracelet shine. Pair with light fabrics like linen or cotton.

- Winter: Layer over sweater sleeves or style with long coats for a cozy yet stylish look.

- Fall & Spring: Mix with transitional outfits leather jackets, scarves, and denim layers.

Caring for Your Bracelet

To keep your Chrome Hearts bracelet looking its best:

- Store it in a dry, soft pouch.

- Clean gently with a silver polishing cloth.

- Avoid harsh chemicals like perfumes or cleaning sprays.

With the right care, your bracelet will stay beautiful for years and even develop a natural patina that makes it more unique.

Wear It Your Way

The Chrome Hearts bracelet isn’t just an accessory it’s a piece of art you can wear. From casual streetwear to elegant evening outfits, it has the power to transform your look instantly. The key is confidence. No matter how you style it, wear it proudly, and it will always make an impact.

In fashion, the best style is your own. The Chrome Hearts bracelet just helps you show it off to the world.

Read More: Fashion

Business

The Complete Homeowner’s Guide to Damp Proofing in South Wales

Damp is one of the most persistent and damaging issues affecting properties across South Wales. With frequent rainfall, high humidity levels, and a large number of older homes, moisture-related problems are extremely common in the region. If left untreated, damp can cause structural deterioration, health concerns, and costly long-term repairs.

This comprehensive guide explains everything homeowners need to know about Damp Proofing South Wales, including causes, warning signs, treatment options, prevention strategies, and the long-term benefits of professional solutions.

Why Damp Is So Common in South Wales

South Wales has a maritime climate, meaning it experiences regular rainfall throughout the year. Coastal winds drive moisture into brickwork, while valleys often retain damp air for extended periods. Combined with older housing stock—particularly Victorian terraces and stone-built properties—this creates ideal conditions for damp problems.

Many properties built before modern building regulations either lack an effective damp proof course (DPC) or have one that has deteriorated over time. Changes in ground levels, poor drainage, and blocked gutters further increase the risk of moisture penetration.

The Three Main Types of Damp

Understanding the type of damp affecting your property is the first step toward effective treatment.

1. Rising Damp

Rising damp occurs when groundwater travels upward through porous building materials such as brick and mortar. This typically happens when a damp proof course is missing, damaged, or bridged.

Common signs include:

- Horizontal tide marks on walls

- Peeling paint and wallpaper

- White salt deposits (efflorescence)

- Crumbling plaster

- Rotting skirting boards

Rising damp usually affects ground-floor walls and rarely rises above one meter.

2. Penetrating Damp

Penetrating damp is caused by water entering through external walls, roofs, chimneys, or faulty gutters. South Wales’ heavy rain makes this type of damp particularly frequent.

You may notice:

- Irregular damp patches on walls

- Stains that worsen after rainfall

- Moss or algae growth externally

- Damp ceilings beneath damaged roofing

Unlike rising damp, penetrating damp can occur at any height within the building.

3. Condensation

Condensation forms when warm, moist air meets cold surfaces such as windows and poorly insulated walls. Everyday activities like cooking, showering, and drying clothes indoors increase humidity levels.

Signs of condensation include:

- Water droplets on windows

- Black mold in corners

- Musty smells

- Damp behind furniture

Condensation is often mistaken for structural damp, making professional diagnosis important.

Why Damp Should Never Be Ignored

Many homeowners delay treatment because damp appears cosmetic at first. However, ignoring the issue can lead to serious consequences.

Structural Damage

Moisture weakens mortar joints and timber structures. Over time, this can result in:

- Wet rot or dry rot

- Warped flooring

- Damaged plasterwork

- Compromised structural beams

The longer damp persists, the more expensive repairs become.

Health Risks

Mold spores thrive in damp environments. Prolonged exposure may cause:

- Respiratory problems

- Asthma flare-ups

- Allergic reactions

- Sinus infections

Children, elderly residents, and those with existing health conditions are particularly vulnerable.

Reduced Property Value

Surveyors often flag damp as a major issue during property inspections. Untreated damp can reduce buyer confidence and lower property value significantly.

Professional Damp Proofing Solutions

Addressing damp effectively requires identifying the root cause. Professional damp proofing specialists in South Wales conduct detailed surveys before recommending treatment.

Chemical Damp Proof Course Injection

This method involves injecting a water-repellent cream into the brickwork to create a new moisture barrier. It is highly effective for treating rising damp.

Repointing and External Repairs

For penetrating damp, repairing damaged brickwork, replacing mortar, and fixing gutters prevents further water ingress.

Waterproof Membranes

Internal waterproof membranes create a protective barrier against moisture, especially in basements and ground-floor rooms.

Basement Tanking Systems

For below-ground spaces, tanking involves applying a waterproof coating to walls and floors to prevent groundwater penetration.

Ventilation Improvements

Installing extractor fans, air bricks, or Positive Input Ventilation (PIV) systems reduces condensation problems.

Each solution is tailored to the specific property and damp type.

The Damp Survey Process

A professional damp survey typically includes:

- Visual inspection of internal and external walls

- Moisture meter readings

- Examination of rooflines and drainage

- Assessment of ventilation systems

- Identification of structural defects

After the survey, the specialist provides a written report outlining recommended treatments and associated costs.

Preventing Damp in Your Home

While professional treatment is essential for serious issues, homeowners can take preventative steps to reduce moisture risks.

Maintain Gutters and Downpipes

Blocked gutters cause rainwater to overflow onto walls, increasing penetration risks. Regular cleaning prevents this.

Improve Ventilation

Use extractor fans in kitchens and bathrooms. Open windows when possible to encourage airflow.

Monitor Ground Levels

External ground should be lower than the damp proof course to prevent bridging.

Fix Leaks Promptly

Even minor plumbing leaks can contribute to long-term damp problems if ignored.

Maintain Consistent Heating

Keeping your home warm during colder months reduces condensation formation.

Damp Proofing for Landlords and Property Investors

Landlords in South Wales have legal responsibilities to provide safe living conditions. Damp and mould complaints can result in tenant disputes and potential legal action.

Investing in professional damp proofing protects:

- Rental income

- Tenant health

- Property value

- Legal compliance

For property investors, addressing damp before listing a property improves marketability and buyer confidence.

Energy Efficiency Benefits

Damp walls lose heat more quickly than dry walls. Eliminating moisture improves insulation performance and reduces heating costs. In a region where winters can be cold and wet, this is particularly beneficial.

Dry walls:

- Retain heat better

- Reduce energy bills

- Improve overall comfort

Damp proofing contributes not only to structural protection but also to energy efficiency.

Choosing the Right Damp Proofing Company in South Wales

When selecting a specialist, look for:

- Experience with local property types

- Qualified surveyors

- Insurance-backed guarantees

- Transparent pricing

- Positive customer reviews

A reputable company will always provide a clear explanation of the problem and avoid unnecessary treatments.

Long-Term Peace of Mind

Damp rarely resolves without intervention. The wet climate in South Wales makes proactive protection essential for homeowners and landlords alike. By investing in professional Damp Proofing South Wales services, you protect your property’s structure, safeguard your family’s health, and maintain long-term property value.

Early diagnosis and treatment prevent minor issues from becoming major repairs. Whether you live in a historic terrace, a coastal cottage, or a modern build, damp proofing ensures your home remains safe, dry, and comfortable throughout the year.

If you notice signs of damp—no matter how small—it is always wise to arrange a professional survey. Taking action today can prevent significant costs tomorrow and provide lasting protection for your South Wales property.

Business

Discover Raspberry Hills: The Rising Star in Streetwear

If you’ve been keeping an eye on the latest streetwear trends, there’s a good chance you’ve come across Raspberry Hills. If not, don’t worry — you’re about to get the scoop.

Raspberry Hills is making waves in the fashion world with its bold designs, clean cuts, and that effortless “I woke up like this” vibe. Whether it’s the iconic Raspberry Hills hoodie, the sharp tracksuit, or the statement-making camo shorts, this brand is carving out a serious name for itself in street fashion. It’s more than just clothing — it’s a statement of confidence, style, and a laid-back yet bold approach to everyday fashion.

Raspberry Hills Apparel: Beyond Clothing — It’s a Way of Life

Streetwear today isn’t just about wearing loud, flashy clothes; it’s about exuding confidence and letting your outfit do the talking. And that’s exactly what Raspberry Hills is all about. Their pieces give you a way to look effortlessly put-together, so you can step out feeling comfortable, stylish, and confident — without the need for over-the-top effort. It’s about wearing pieces that express who you are without needing a word.

What makes Raspberry Hills stand out is that it keeps its designs fresh and accessible. The brand caters to those who want to stay stylish while embracing the idea that fashion should feel natural. This approach is particularly appealing to the current generation of streetwear enthusiasts who want versatility and practicality, all while maintaining a certain edge.

The Raspberry Hoodie: An Instant Essential

Let’s face it — a hoodie is a must-have in any streetwear collection. But the Raspberry Hills hoodie? It’s anything but basic. The fit is just right: slightly oversized but not drowning you, giving off that cool, laid-back vibe that’s perfect for a quick outing or layering up for something a little more chill. It’s the kind of piece that makes you look styled without even trying.

And the fabric? It’s soft, breathable, and comfortable — no stiff, uncomfortable material here. You know the type of hoodie that feels like a second skin? That’s the Raspberry Hills hoodie. Whether you’re lounging at home, running errands, or just hanging with friends, it offers the perfect combination of comfort and style. You can throw it on and instantly elevate your outfit, no matter how casual the occasion.

The Raspberry Hills Tracksuit

Matching sets are having a moment right now, and the Raspberry Hills tracksuit takes that to the next level. Gone are the days of stressing over what goes with what. With a tracksuit, the outfit is already done for you. Just throw it on, and boom — you’ve got a stylish, coordinated look that doesn’t require much effort.

What’s great about the Raspberry Hills tracksuit is that it doesn’t just look good; it feels good, too. The material is both comfortable and practical, making it perfect for a range of activities. Whether you’re out for a casual day in the city, hitting the gym, or lounging at home, the tracksuit’s versatility makes it a go-to piece. The clean lines and sleek design give off an air of confidence, making it the ultimate choice for anyone who wants a polished yet effortless look.

The best part? Tracksuits are not just for athletic wear anymore. They’ve evolved into an essential part of modern street fashion, and Raspberry Hills perfectly captures this shift. You can wear it as a full set or mix and match it with other pieces — either way, you’re getting a clean, put-together look without any stress.

Raspberry Hills Camo Shorts: Your Summer Statement Piece

When it’s time to turn heads, the Raspberry Hills camo shorts are your go-to. Camo is a streetwear staple, but Raspberry Hills keeps it fresh and modern, so you can rock it without worrying about looking outdated. These shorts blend the classic camo print with updated design elements, making them stand out in a way that’s both bold and understated.

The best part about the Raspberry Hills camo shorts is how easy they are to style. Pair them with a simple tee or a solid-colored hoodie, and you’ve got a look that’s both stylish and effortless. These camo shorts aren’t just about the print; they’re about attitude. Bold enough to catch attention but relaxed enough to keep your style effortlessly cool.

Summer streetwear has never looked this good. Camo remains a timeless choice in street fashion, but Raspberry Hills reimagines it to keep things fresh and exciting. Whether you’re hitting the streets, the beach, or just lounging in the park, these shorts will definitely elevate your warm-weather wardrobe.

Why Raspberry Hills Clothing Is Gaining Traction

Raspberry Hills is rising fast in the streetwear scene because it taps into what people really want — clothing that’s wearable, stylish, and comfortable. Gone are the days of overpriced hype pieces that sit in your closet, never truly serving a practical purpose. Raspberry Hills brings you:

- Comfort: The hoodie and tracksuit feel cozy and functional, while the camo shorts are breathable and perfect for warmer months.

- Confidence: The designs are bold yet easy to wear, without looking overdone. Each piece allows you to express your unique style, effortlessly.

- Versatility: From the tracksuit to the camo shorts, every piece is designed to be mixed and matched, allowing for endless styling options. You can wear Raspberry Hills clothing for almost any occasion, from casual meet-ups to lounging at home.

People are looking for pieces that last, and Raspberry Hills delivers. The brand’s dedication to quality and design distinguishes it from other streetwear labels.

How to Style Raspberry Hills Without Overdoing It

The key to rocking Raspberry Hills is keeping your look balanced. Here are a few styling tips:

- Camo shorts: Keep the top simple. A plain tee or hoodie will let the camo be the star of the show. If you want a more elevated look, throw on some chunky sneakers to complete the outfit.

- Bold hoodie: Pair with neutral or plain pants to keep things relaxed but still stylish. You can also layer it with a denim jacket or a light bomber for cooler weather.

- Full tracksuit: If you’re going head-to-toe Raspberry Hills, keep accessories minimal. The set speaks for itself. Opt for a clean, simple cap or sneakers to round out the look.

In streetwear, less is often more. Confidence over clutter is the key to nailing the look. You don’t need to over-accessorize or try too hard — just let the pieces speak for themselves.

Is Raspberry Hills Worth It?

Short answer: Yes.

Raspberry Hills is all about making streetwear that feels designed for real people who live in their clothes. Whether you’re out with friends, traveling, or just posting an outfit online, these pieces hold their own. The brand doesn’t just follow trends; it sets them.

- The hoodie becomes a go-to for casual days.

- The tracksuit is your easy outfit hack for when you want to look good without the stress.

- The camo shorts are your summer flex that shows off your style without trying too hard.

Raspberry Hills is about clothing that stands the test of time, with pieces that stay relevant year after year.

Conclusion

Raspberry Hills is more than just another name in streetwear; it’s building a solid foundation with pieces that are clean, wearable, and full of confidence. If you’re looking to upgrade your wardrobe with pieces that hit all the right notes, Raspberry Hills is definitely worth checking out. It’s a brand that understands the balance between comfort, style, and confidence — three elements every streetwear enthusiast needs.

Business

Rebuild Your Business Credit Score: Strategies for Success

A bad credit score for business puts your company in a difficult situation. You are unable to obtain the loans that you require to expand. The suppliers do not want to offer you good terms of payment. Your company is caught in a rut and seems to be unable to keep up as competitors are ahead.

Your credit score with the business can be rebuilt gradually. It is not going to come overnight. However, with practice, you will see an improvement in your score. Businesses that have progressive improvement with time are rewarded by the credit system.

Ways to Rebuild Business Credit Score

Dispute Errors and Outdated Information

Your credit report might have mistakes. These errors can drag down your score unfairly. You need to check all three major agencies, such as Experian, Equifax, and Credit safe.

You can file disputes directly with each agency when you spot problems and you can send it right away. This might include paid invoices, bank statements, or letters confirming cleared debts.

The County Court Judgments (CCJs) can actually vanish if you pay within a month. You’ll need to apply to the court directly. The satisfied CCJs stick around for six years, but at least they’re marked as paid.

Been linked to a company you never directed? You can challenge it. The credit agencies must investigate and respond within 28 days by law. Stay on top of them if they miss this deadline.

- Look for name spelling errors that link others’ debts to you

- Check for duplicate entries that count negatives twice

- Search for outdated addresses that might miss positive records

- Review director associations from companies you’ve left

- Examine expired CCJs that should have dropped off already

Pay Off Outstanding Debts and CCJs

Active CCJs hurt your score most severely. You can target these first to stop the bleeding. Next, tackle defaults from largest to smallest to maximize score improvement. The creditors may accept partial settlements if you negotiate well.

You can get loans to clear your debts and can apply for online bad credit loans in the UK. You can use this to consolidate multiple business debts. These loans can simplify your repayment schedule and potentially improve cash flow. They often approve businesses with troubled credit histories. Some lenders specialize in helping companies rebuild their financial standing.

You can ask creditors to update your status to “satisfied” once you’ve paid. This won’t remove the black mark entirely, but it shows you’ve made good. HMRC debts deserve special attention. These tax authorities report payment behavior to credit agencies.

- Set up direct debits for minimum payments

- Keep payment receipts as proof for at least two years

- Consider the snowball method

- Photograph “paid in full” letters for your records

- Request written confirmation

File Accounts and Returns on Time

Late Companies House filings damage your score. The credit agencies check this public data constantly. Your confirmation statement comes due yearly, and mark this date clearly in your calendar.

Annual accounts follow strict deadlines based on your company structure. These deadlines can trigger automatic penalties starting at £150 and climbing quickly. These fines reach £1,500 quickly for public companies.

You can set multiple reminders 30, 15, and 5 days before deadlines. This could be phone alerts, email notifications, or anything else. This simple habit prevents costly mistakes that hurt your score for years.

Your consistent filing builds trust with credit agencies over time. They track your pattern, not just individual events.

- Use accounting software

- Consider changing your company’s accounting reference date

- File online rather than by post to avoid mail delays

- Keep Companies House authentication codes

- Check your filing status online regularly

Build Positive Payment History

You pay suppliers before the due date. You can find trade credit accounts that actually report to agencies. Not all do! Ask potential suppliers directly if they share payment data. Business credit cards, when paid in full monthly, create positive records quickly.

You put utility bills in your business name rather than your personal. These regular payments build history steadily.

The big suppliers report more consistently than the smaller ones. Their data carries more weight with credit agencies. You can balance your payment strategy to prioritize these key relationships.

- Ask existing suppliers to increase credit terms after 3-4 months of early payments

- Set up automated payments for recurring bills to avoid oversights

- Space out payments to create more positive reporting events

- Consider trade credit insurance to protect your payment history

- Review payment terms before agreeing to them

Manage Director’s Personal Credit

Many lenders check both business and director credit scores. They’re linked closely in their lending decisions. Personal CCJs, IVAs, or bankruptcies severely limit business borrowing options.

You can keep your personal credit card usage under 30% of available limits. This ratio matters more than the actual amounts. You can register on the electoral roll at your business address to strengthen the connection between personal and business identities.

Separate personal and business finances completely. You use different cards, accounts, and payment methods. Joint liability continues even after leaving a company, so check your associations regularly.

You can get online bad credit loans in the UK. This can sometimes bridge personal finance gaps without impacting business credit. These lending options understand entrepreneurial challenges. They often look beyond traditional credit scores. Some offer flexible repayment terms suited to fluctuating business income.

- Check your personal credit file with all three major agencies

- Dispute any errors on personal reports

- Avoid multiple credit applications in short timeframes

- Close unused credit accounts

- Maintain a perfect payment history on a personal credit card

Establish Trade References

It is possible to open accounts with suppliers who submit payment information. There are 3-5 critical relationships that you can target to establish a strong foundation. You can begin with simple credit limits, which you can easily settle off early.

A builder, merchants, and office suppliers are the usual ones reporting to credit agencies. These industries are good entry points. After six months of flawless payments, ask for small credit gifts to indicate improvement.

Some loan applications require written trade references. These can be inquired of contented suppliers once a good history has been built.

- Go on business with the finance departments of supplier companies

- Prepare congratulatory letters when the credit limit is approved

- Record all early payments that you make

- Make regular visits to suppliers every three months

Conclusion

The practices could appear small, but they accumulate in huge transformations that lenders have of your company. Record your improvement every month to keep yourself going when the process is slow.

Many successful businesses have used the bad ratings to recover and be in a position to obtain the money they required to succeed. Don’t stick to quick fixes only, but rather stick to those habits that can make your credit great.

-

Business3 years ago

Cybersecurity Consulting Company SequelNet Provides Critical IT Support Services to Medical Billing Firm, Medical Optimum

-

Business3 years ago

Team Communication Software Transforms Operations at Finance Innovate

-

Business3 years ago

Project Management Tool Transforms Long Island Business

-

Business2 years ago

How Alleviate Poverty Utilized IPPBX’s All-in-One Solution to Transform Lives in New York City

-

health3 years ago

Breast Cancer: The Imperative Role of Mammograms in Screening and Early Detection

-

Sports3 years ago

Unstoppable Collaboration: D.C.’s Citi Open and Silicon Valley Classic Unite to Propel Women’s Tennis to New Heights

-

Art /Entertainment3 years ago

Embracing Renewal: Sizdabedar Celebrations Unite Iranians in New York’s Eisenhower Park

-

Finance3 years ago

The Benefits of Starting a Side Hustle for Financial Freedom