Business

Finance Plays a Crucial Role in Business Success

Introduction

Every thriving business shares one common thread: strong financial management. “Finance plays a crucial role in business success” isn’t just a catchy phrase—it’s a reality experienced by startups and global corporations alike. From securing initial funding and managing daily cash flow to planning for growth and safeguarding against risks, finance underpins every decision a company makes. Good financial planning guides entrepreneurs, steers operations, and instills confidence in investors. In this article, we’ll explore the many ways business finance importance shows up, why it matters for companies of all sizes, and how you can harness finance to drive lasting success.

1. Securing Startup Funding

Every business begins with an idea—and capital to bring that idea to life. The finance role in business success starts here:

- Bootstrapping: Using personal savings or reinvesting early revenues to maintain control but grow slowly.

- Loans and Lines of Credit: Banks and credit unions provide funds at interest, enabling you to buy equipment or cover initial payroll.

- Investor Capital: Angel investors and venture capitalists supply cash in exchange for equity, accelerating growth but sharing ownership.

Choosing the right mix of funding sources sets the stage for sustainable development and avoids costly debt or dilution down the road.

2. Managing Cash Flow

Cash flow—the net amount of cash moving in and out of your business—is the lifeblood of operations. Good finance functions ensure:

- Timely Invoicing: Quick billing shortens the gap between sale and cash received.

- Expense Control: Monitoring payments for rent, utilities, and suppliers to prevent overspending.

- Cash Flow Forecasting: Predicting slow months and planning reserves to cover shortfalls.

Without positive cash flow, even profitable companies can face bankruptcy. Maintaining liquidity safeguards your ability to pay employees, meet obligations, and seize new opportunities.

3. Budgeting and Forecasting

A budget is a financial blueprint that outlines expected revenues and expenses over a period (monthly, quarterly, or annually). Effective budgeting:

- Sets Clear Targets: Sales, marketing spend, hiring plans, and capital expenditures.

- Monitors Variances: Comparing actual results to the budget to identify overspending or missed revenue early.

- Informs Forecasts: Using historical data and market trends to project future performance.

By aligning spending with strategic priorities and adjusting plans as conditions change, companies stay on course toward their goals.

4. Investment Decision-Making

Deciding where to invest limited resources is a core aspect of finance’s impact on business success:

- Return on Investment (ROI): Calculating the profit generated by marketing campaigns, new equipment, or R&D.

- Net Present Value (NPV) and Internal Rate of Return (IRR): Evaluating long-term projects by comparing future cash flows to today’s costs.

- Opportunity Cost: Weighing one investment against others to choose the highest-value option.

Sound financial analysis prevents wasted capital and channels funds into initiatives that drive growth and competitive advantage.

5. Risk Management and Insurance

Every business faces risks—market shifts, supplier failures, or legal liabilities. Finance teams safeguard companies by:

- Identifying Risks: Cataloging potential events that could harm revenue or reputation.

- Quantifying Impact: Estimating the financial costs of supply chain delays, data breaches, or natural disasters.

- Mitigating Risks: Purchasing insurance (liability, property, business interruption) and establishing emergency funds.

- Implementing Controls: Policies on cybersecurity, quality assurance, and compliance reduce the chance of costly errors.

Proactive risk management ensures a setback doesn’t derail the entire enterprise.

6. Performance Measurement and KPIs

Finance functions track key performance indicators (KPIs) to gauge success and guide decisions:

- Gross Profit Margin: Revenue minus cost of goods sold, indicating how well you price products.

- Operating Cash Flow: Cash generated by core business activities, a true sign of viability.

- Current Ratio: Current assets divided by current liabilities, measuring short-term liquidity.

- Customer Acquisition Cost (CAC) vs. Lifetime Value (LTV): Ensuring marketing spend yields profitable customers.

Regular KPI reviews empower leaders to celebrate wins, address weaknesses, and pivot strategies when numbers warn of trouble.

7. Cost Control and Efficiency

Keeping expenses in check without sacrificing quality boosts profitability:

- Zero-Based Budgeting: Every cost must be justified each period, curbing legacy expenses.

- Process Automation: Investing in software for invoicing, payroll, and inventory reduces manual errors and labor costs.

- Supplier Negotiations: Bulk purchasing, long-term contracts, and alternative vendors trim material expenses.

- Lean Principles: Streamlining workflows, minimizing waste, and optimizing resource allocation.

By prioritizing efficiency, businesses maximize the returns on every dollar spent.

8. Financing Growth and Expansion

When your business outgrows current resources, finance teams explore:

- Equity Financing: Selling shares to raise big sums for new facilities or market entry.

- Debt Financing: Issuing bonds or securing term loans to fund expansion while retaining ownership.

- Franchising Models: Allowing others to invest in and operate under your brand, accelerating geographic reach.

- Strategic Partnerships: Joint ventures or partnerships that share costs, risks, and expertise.

Thoughtful growth financing ensures you scale without overleveraging or losing strategic control.

9. Strategic Financial Planning

Long-term success demands more than monthly budgets—it requires strategic planning:

- 5–10 Year Financial Projection: Forecast revenues, profits, and capital needs under various scenarios.

- Scenario Analysis: Modeling best-case, worst-case, and most-likely financial outcomes to stress-test plans.

- Capital Structure Management: Balancing debt and equity to optimize the cost of capital and maintain shareholder value.

- Exit Planning: Preparing for eventual sale, public offering (IPO), or ownership transition with clear valuation targets.

Strategic financial planning aligns resources with vision, ensuring every decision contributes to the company’s future.

10. Building Stakeholder Confidence

Transparent, accurate finance builds trust with:

- Investors and Lenders: Timely financial reports and solid forecasts reassure backers of stability.

- Employees: Clear communication on financial health fosters engagement and loyalty.

- Suppliers and Partners: Consistent payments and robust credit profiles secure favorable terms.

- Customers: Investing in quality and service signals commitment to long-term relationships.

This confidence translates into more favorable financing, better contracts, and a stronger brand reputation.

Conclusion

Finance is far more than number-crunching—it’s the engine that drives every aspect of a successful business. From securing startup funding and managing cash flow to strategic planning and stakeholder confidence, the finance role in business success is undeniable. By mastering budgeting, investment analysis, risk management, and performance measurement, companies can make informed decisions that fuel growth, control costs, and adapt to change. Whether you’re launching a new venture or steering an established enterprise, prioritizing sound financial management ensures you not only survive but thrive in a competitive landscape. Embrace finance as your strategic partner, and watch your business reach new heights.

Business

Warehouse Process Optimization for Modern Warehouse Operations

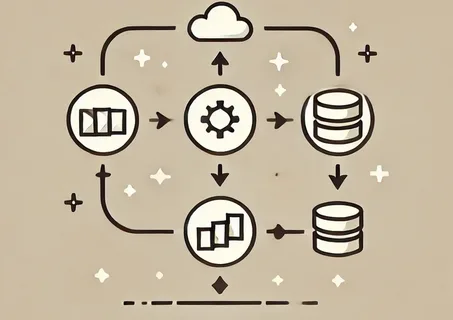

A warehouse process is essential for efficiently managing how goods move, are stored, and are shipped. Modern operations increasingly depend on warehouse management systems (WMS) to maintain accuracy, reduce errors, and track inventory in real time. By utilizing integrated systems, warehouse locations are optimized for performance, ensuring smoother logistics and faster fulfillment.

Retail brands rely heavily on retail management software to coordinate operations, and advanced inventory control systems are critical in preventing stock imbalances. With these systems in place, warehouse operations become predictable, more efficient, and faster. Additionally, an integrated order management system (OMS) can improve order fulfillment accuracy, providing a seamless flow across supply chains and increasing operational performance.

Core Components That Define an Efficient Warehouse Process

Efficient warehouse processes are supported by systems that coordinate all operations. Key components that contribute to this efficiency include:

- Warehouse Picking: Accurate picking ensures order fulfillment is on time and correct.

- Warehouse Location Mapping: Optimizing the layout for faster product movement.

- User Management: Controlled access to ensure security and productivity.

- IT System Management Tools: These tools ensure smooth operations across all systems.

Additionally, a quality management system (QMS) guarantees process consistency and reduced errors. The warehouse management system application plays a central role in standardizing processes and improving overall operational efficiency.

Warehouse Operations Driven by Digital Control Systems

In modern warehouses, automation is critical. WMS systems are designed to manage inventory movements intelligently, while enterprise systems like SAP provide robust solutions for larger environments. Digital tools in warehouse operations help strengthen:

- Inventory Control: Ensures real-time inventory visibility.

- Order Management: Enhances order fulfillment accuracy.

- Retail Operations Synchronization: Ensures that sales and inventory data align seamlessly.

These digital systems provide transparency, allowing managers to monitor stock movement in real time and make proactive decisions to maintain smooth operations.

Warehouse Process Alignment with Retail and Supply Chains

As retail businesses grow, their warehouse operations must be aligned to meet omnichannel demands. A connected retail management system integrates sales and inventory data, supporting efficient warehouse fulfillment. Key benefits include:

- Faster Warehouse Picking: Boosting efficiency and reducing order processing times.

- Controlled Warehouse Location Usage: Optimizing storage space.

- Automated Logistics Flows: Reducing manual interventions in operations.

These advancements improve overall supply chain optimization, enhancing the customer experience by ensuring faster and more reliable order fulfillment.

Warehouse Process Visibility Using Warehouse Tracking System

A transparent warehouse process relies on real-time data accuracy. A warehouse tracking system ensures instant visibility of inbound and outbound activities, improving operational control across departments. This real-time data allows managers to:

- Detect potential delays before they impact customers.

- Sync tracking data automatically with warehouse management systems.

- Strengthen inventory control to reduce discrepancies.

In turn, this leads to better planning, enhanced operational stability, and reduced risk of inventory errors.

Warehouse Process Integration with Retail Management Software

For optimal retail growth, a connected warehouse process is essential. Integration between warehouse management systems (WMS) and retail management software allows real-time updates on stock availability across multiple sales channels. This leads to:

- Faster Fulfillment: Orders are processed and dispatched more quickly.

- Improved Coordination: Synchronizing sales and warehouse data for streamlined operations.

- Enhanced Customer Satisfaction: Real-time updates improve service reliability and trust.

Through this integration, businesses can manage inventory more effectively, improve warehouse workflows, and offer better customer experiences.

Workforce Enablement and Warehouse Manager Job Requirements

People are the driving force behind warehouse success, and modern warehouse managers must possess strong digital skills to oversee operations. Key warehouse manager responsibilities today include:

- Monitoring Warehouse Operations: Ensuring daily activities run smoothly.

- Improving Process Efficiency: Identifying bottlenecks and making improvements.

- Managing IT Systems: Ensuring all technology tools work cohesively.

These skills help warehouse managers lead teams effectively, streamline processes, and ensure the consistent performance of warehouse systems.

Warehouse Process Enablement Through Dubai Warehouse Management Solutions

For businesses operating in the Middle East, Dubai warehouse management solutions offer a region-specific approach to managing logistics. These systems ensure:

- Compliance with local regulations and standards.

- Data Accuracy: Ensures reporting is reliable for better decision-making.

- Scalability: Supports growing operations, managing high volumes efficiently.

These systems enable enterprises to manage logistics operations smoothly, giving them a competitive advantage in the regional marketplace.

Technology-Driven Warehouse Process Optimization

Automation plays a critical role in warehouse process optimization. WMS systems provide real-time accuracy, while order management systems (OMS) ensure quick dispatch. Digital transformation tools contribute to:

- Streamlined Warehouse Operations: By automating routine tasks.

- Improved Retail Operations: Reducing manual effort and boosting efficiency.

- Supply Chain Optimization: Ensuring consistent and reliable fulfillment.

As a result, businesses can achieve sustainable growth by continually improving their warehouse processes.

How Ginkgo Retail Supports Smarter Warehouse Operations

Ginkgo Retail provides intelligent warehouse enablement through a platform that integrates various operational systems, improving both visibility and accuracy. The platform supports:

- Scalable Logistics Automation: Helping businesses grow without increasing operational complexity.

- Enhanced Inventory Control: Ensuring products are accurately tracked and managed.

- Aligned Retail Operations Execution: Synchronizing sales and inventory management for efficient order fulfillment.

By using Ginkgo Retail’s system, warehouses are able to optimize their processes and achieve more streamlined, cost-effective operations.

Strategic Takeaway on Warehouse Process Excellence

A modern, scalable warehouse process is key to operational success. With the right digital tools—from warehouse management systems to integrated logistics automation—businesses can streamline operations and support growth. Systems like Ginkgo Retail help ensure that warehouses remain agile, transparent, and optimized for efficiency.

FAQs on Warehouse Process and Warehouse Management

1. What is a warehouse process in logistics operations?

A warehouse process manages the storage, movement, and order fulfillment of goods.

2. How does a warehouse management system improve performance?

A WMS improves accuracy, visibility, and inventory management, leading to faster and more reliable operations.

3. Why are Dubai warehouse management solutions important?

These solutions ensure compliance with regional standards, support scalability, and enhance reporting accuracy.

4. What role does warehouse picking play in fulfillment?

Warehouse picking ensures that products are selected quickly and accurately, which is crucial for efficient order delivery.

5. How does Ginkgo Retail support warehouse process optimization?

Ginkgo Retail enhances visibility, inventory control, and logistics automation, streamlining warehouse workflows.

6. What skills define warehouse manager job requirements today?

Warehouse managers need strong digital skills, familiarity with warehouse operating systems, and the ability to improve process efficiency.

7. How does logistics automation improve warehouse operations?

Logistics automation reduces human errors, speeds up order fulfillment, and increases throughput.

8. Can Ginkgo Retail integrate with existing warehouse systems?

Yes, Ginkgo Retail integrates seamlessly with existing warehouse management platforms to optimize operations.

Business

Digital vs. Human Guidance in Mutual Fund Distribution

The digital revolution has significantly changed how we approach investing. With just a few taps or clicks, investors can start Systematic Investment Plans (SIPs), track their portfolios, and access a wealth of financial information through apps and websites. This convenience has led many to believe that mutual fund distributors are becoming obsolete. However, investing is more than just executing transactions—it involves making well-informed decisions, staying disciplined, and aligning investments with personal goals. While digital platforms provide easy access and execution, mutual fund distributors still play a crucial role in helping investors navigate complexity, manage emotions, and build long-term wealth.

The Strengths of Digital Platforms

Digital platforms have made investing accessible to anyone with an internet connection. They offer numerous advantages:

- Quick and paperless investment processes

- Easy access to mutual fund information and calculators

- Real-time portfolio tracking

- Lower entry barriers for first-time investors

These tools excel at simplifying execution, improving transparency, and providing real-time data. However, despite their efficiency, digital platforms are not equipped to fully understand an investor’s financial situation or emotional state, which can influence their decision-making.

The Missing Link in Digital-Only Investing

While digital platforms offer convenience, they also present challenges that often go unaddressed. One of the major drawbacks of digital-only investing is information overload. Investors are bombarded with countless fund options, market opinions, return comparisons, and investment strategies—without clear direction.

Common issues include:

- Difficulty in selecting suitable funds

- Overlapping investments across similar schemes

- Panic-driven decisions during market volatility

- Lack of accountability or follow-up

In the absence of personalized guidance, investors may be tempted to make hasty decisions based on short-term emotions rather than sticking to a well-thought-out long-term strategy.

Personalized, Need-Based Financial Planning

Each investor has distinct financial goals. Whether it’s buying a home, funding a child’s education, planning for retirement, or building long-term wealth, each objective has its own set of time horizons, risk appetites, and investment requirements. This is where mutual fund distributors provide essential value.

A mutual fund distributor helps by:

- Understanding an investor’s unique needs and priorities

- Mapping SIPs to specific financial goals

-

Organizing investments according to risk appetite and time frame

- Ensuring each investment serves a specific purpose

Unlike algorithms, human distributors are able to take into account the nuances of life situations and adjust investment strategies accordingly.

Behavioral Guidance During Market Ups and Downs

Market volatility is inevitable, and while digital platforms can show numbers and charts, they can’t provide reassurance during market corrections. This is where mutual fund distributors excel. They offer critical behavioral guidance by:

- Preventing panic withdrawals during market downturns

- Encouraging investors to stick with their SIPs and long-term strategy

- Helping investors understand that market fluctuations are a normal part of long-term investing

- Reinforcing the importance of patience and consistency

The difference between average investors and successful investors often comes down to emotional control. A trusted mutual fund distributor helps investors maintain discipline, which can make a significant difference to their financial outcomes over time.

Simplifying Investment Complexity

Mutual funds come with various categories, strategies, and risk levels, which can overwhelm even seasoned investors. Digital platforms often fail to provide clear, actionable guidance on these complexities. This is where mutual fund distributors play a vital role:

- Explaining fund categories in simple, understandable terms

- Avoiding unnecessary or overlapping investments

- Periodically reviewing and rebalancing portfolios

- Adapting investments to match evolving goals and market conditions

By offering clarity and simplifying decision-making, mutual fund distributors ensure that investors stay on track with their long-term objectives.

Building Long-Term Relationships Over One-Time Transactions

Digital platforms are great for executing transactions, but they tend to provide limited support once an investment is made. A mutual fund distributor, however, focuses on building a long-term relationship, providing ongoing support through:

- Regular portfolio reviews

- Adapting strategies as life stages change (e.g., marriage, children, retirement)

- Acting as a financial partner rather than a mere salesperson

Technology and Human Guidance: A Powerful Combination

Modern mutual fund distributors are not against technology—they embrace it. By integrating digital tools like platforms, dashboards, and analytical software, distributors combine the best of both worlds: technology-driven efficiency and personalized human guidance. This combination offers investors:

- Better decision-making capabilities

- Greater transparency

- Stronger investor confidence

- Improved long-term outcomes

By using technology to enhance their service offering, mutual fund distributors can ensure that investors get the most accurate data and analysis while also benefiting from expert advice and support.

Who Benefits Most from a Mutual Fund Distributor?

While any investor can benefit from professional guidance, mutual fund distributors are especially valuable for:

- First-time investors who need help understanding the basics of mutual funds and asset allocation.

- Busy professionals with limited time to research or manage their investments.

- Retirees looking for stability and income planning.

- Families planning for long-term financial needs like education and home buying.

- Investors who value discipline, consistency, and clarity in their investment approach.

The Long-Term Value of Human Guidance in Wealth Creation

Digital platforms may excel at execution and convenience, but wealth creation is a deeply behavioral process that requires ongoing, long-term management. Market cycles, volatility, changing financial priorities, and life events demand continuous decision-making and adaptation, something that digital platforms alone cannot fully address.

For example, during market downturns, investors may panic and consider stopping their SIPs or redeeming investments prematurely. A mutual fund distributor helps keep emotions in check, reinforcing the long-term strategy and guiding the investor through short-term turbulence. This emotional support can significantly enhance long-term returns.

Additionally, as life circumstances evolve—such as marriage, children’s education, career changes, or retirement—portfolios must be periodically reviewed and rebalanced. A distributor proactively adjusts strategies to ensure that investments remain aligned with changing goals, something most investors overlook when managing investments independently.

Accountability also plays a crucial role in maintaining a long-term investment plan. Working with a distributor makes it more likely that investors will stick to their SIPs, increase contributions as their income grows, and periodically review their portfolios. This structured, disciplined approach ensures that investing remains a well-managed, ongoing process rather than a one-time task.

Conclusion: Why Human Guidance Still Matters in the Digital Age

While digital platforms have made investing easier, they cannot replace the human touch that adds value to long-term wealth creation. Mutual fund distributors bring structure, emotional support, and personalized guidance to the investment process. By blending the efficiency of technology with the expertise of human advisors, mutual fund distributors ensure that investors not only execute transactions but also make well-informed decisions that align with their life goals.

In the digital age, the future of investing lies not in choosing between technology and human guidance, but in combining both to build a secure, meaningful, and prosperous financial future.

Business

Medical Waste Management Market: Insights and Growth Forecast

The global Medical Waste Management Market is experiencing impressive growth, with a current market size of USD 5.5 billion and a projected future value of USD 19.4 billion, representing a CAGR of 13.4%. This growth reflects both evolving trends in product usage and the increasing adoption of medical waste management solutions across regions. Roots Analysis has published an insightful report on the market, providing historical trends, current developments, and future projections to help decision-makers, investors, and industry participants better navigate the landscape.

Market Overview and Forecast

The Medical Waste Management Market has been shaped by a combination of factors, including the rise of healthcare facilities, stricter regulations on waste disposal, and technological advancements in waste treatment methods. This market is expected to continue growing due to heightened awareness of environmental sustainability and the need for safer, more efficient waste disposal processes.

Key insights from the market report include:

- Current Market Size: USD 5.5 billion

- Projected Market Size (2035): USD 19.4 billion

- Compound Annual Growth Rate (CAGR): 13.4%

The study explores how industry trends, actual performance, and new product adoptions contribute to this growth, offering a reliable data-driven foundation for market participants. Importantly, the report avoids speculative analysis, focusing instead on verified data to provide a clear, actionable understanding of market dynamics.

Market Scope and Segmentation

The market analysis includes an extensive breakdown of the key drivers, opportunities, and competitive landscape within the global medical waste management industry. It covers various facets of the market, such as:

- Types of Services Offered

- Types of Waste

- Treatment Sites

- Treatment Methods

- Categories of Waste

- Key Geographical Regions

- Key Market Players

The report also features:

- Market Size for 2025 and 2035

- CAGR Projections until 2035

- Comprehensive Segmentation Insights

- Excel Data Packs (Complimentary)

This segmentation allows stakeholders to make informed decisions based on granular insights across different categories and regions.

Key Regions and Comparative Insights

The global medical waste management market is segmented across the following regions:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and North Africa

- Rest of the World

Each region is evaluated based on its market size, revenue performance, and contribution to the global market. Insights into regional developments and trends further help businesses tailor their strategies to specific markets.

Technological and Strategic Insights

The Roots Analysis report also provides a deep dive into the technological advancements and strategic activities that are shaping the future of the market. Topics covered include:

- Technological Advancements & R&D: Innovations in waste treatment methods, sustainable practices, and digital waste management solutions.

- Formulation & Delivery Innovations: New product formulations and efficient delivery mechanisms for waste management.

- Marketing & Distribution Strategies: Emerging trends in how medical waste management companies market and distribute their services.

- Pricing Models & Cost Structures: Analysis of pricing strategies across different service categories.

- Manufacturing & Supply Chain Trends: Key trends in the supply chain that impact the medical waste management industry.

These insights are neutral, grounded in empirical evidence, and supported by primary research, providing a comprehensive view of the market landscape.

Key Market Players

The report features profiles of major companies in the medical waste management industry, detailing their product portfolios, strategic initiatives, and recent developments. Some of the leading players include:

- ACE WASTE

- Averda

- Axil Integrated Service

- Clean Harbors

- Cleanaway Waste Management

- Curtis Bay Medical Waste Services

- E-Coli Waste Management

- GreenTech Environ Management

- Heritage Environmental Services

- Initial Medical

- Medicare

- MedPro Disposal

- REMONDIS Mendison

- Stericycle

- Trilogy MedWaste

- Triumvirate Environmental

- Veolia

- WM

For each company, the report provides insights into:

- Product portfolio and focus areas

- Operational footprint and regional presence

- Financial and strategic performance

- Recent developments, such as partnerships, market entries, and acquisitions.

Report Structure

The Roots Analysis report is structured to offer easy access to detailed insights:

- Part 1: Market Overview

- Part 2: Market Size by Regions

- Part 3: Market Revenue by Countries

- Part 4: Market Competition by Key Players

- Part 5: Company Profiles

This structure is designed to provide a clear, comprehensive view of the market, helping businesses strategize their next moves.

Why Employ Roots Analysis in the Era of Artificial Intelligence

In an era driven by technological advancements, particularly AI and machine learning, Roots Analysis remains committed to providing tailored, data-rich insights for their clients. Their robust methodology and domain expertise offer businesses the ability to make smart, informed decisions without being overwhelmed by complex data sets.

Key reasons for utilizing Roots Analysis include:

- Tailored Insights: Custom reports based on client-specific needs.

- Smart Decision Support: Insights that enable companies to make informed, strategic decisions.

- Expert Guidance: Access to the highest quality market intelligence to ensure business success.

Services Offered by Roots Analysis

Roots Analysis provides a wide array of services to support businesses in the life sciences, healthcare, and other industries:

- Consulting Services: Offering tailored insights supporting both strategic and tactical requirements.

- Subscription Services: Providing access to a library of market intelligence reports with unlimited downloads and on-demand research support.

- Bespoke Market Assessments: Custom research to track trends, dynamics, and competitive positioning in the medical waste management and other sectors.

Conclusion

For businesses involved in the Medical Waste Management industry, the Roots Analysis report is a valuable resource to help understand market dynamics, stay ahead of trends, and make informed strategic decisions. Whether you’re an investor, a company looking to expand, or a decision-maker within the industry, this report offers the insights needed to drive success in an increasingly competitive market.

-

Business3 years ago

Cybersecurity Consulting Company SequelNet Provides Critical IT Support Services to Medical Billing Firm, Medical Optimum

-

Business3 years ago

Team Communication Software Transforms Operations at Finance Innovate

-

Business3 years ago

Project Management Tool Transforms Long Island Business

-

Business2 years ago

How Alleviate Poverty Utilized IPPBX’s All-in-One Solution to Transform Lives in New York City

-

health3 years ago

Breast Cancer: The Imperative Role of Mammograms in Screening and Early Detection

-

Sports3 years ago

Unstoppable Collaboration: D.C.’s Citi Open and Silicon Valley Classic Unite to Propel Women’s Tennis to New Heights

-

Art /Entertainment3 years ago

Embracing Renewal: Sizdabedar Celebrations Unite Iranians in New York’s Eisenhower Park

-

Finance3 years ago

The Benefits of Starting a Side Hustle for Financial Freedom