Business

Finance Azure Elevates Business Operations with IPPBX’s Integrated Business Platform

In today’s fast-paced business environment, seamless communication and collaboration tools aren’t just luxuries, they’re necessities. As more organizations recognize this, they’re turning to robust solutions that offer more than just basic connectivity. IPPBX, a renowned service provider, stands out in this domain by offering an integrated business platform, tailor-made for modern businesses that require comprehensive solutions.

One company that has astutely recognized the advantages of IPPBX’s offerings is Finance Azure. This institution has long prided itself on helping individuals and businesses strike a balance between immediate needs, long-term objectives, and unforeseen circumstances. And now, with the integration of IPPBX’s suite of tools, Finance Azure has exponentially enhanced its service delivery.

The cornerstone of IPPBX’s appeal lies in its innovative collaboration tool. It isn’t merely a communication medium; it’s a hub for all things business. Imagine a single portal that not only provides a phone line but also allows users to store, share, edit, and create a range of documents from Word to PowerPoint. Its capacity to enable Visio-like flow chart creations, which makes it possible to easily visualize and comprehend complex data, further demonstrates this versatility.

IPPBX’s collaboration tool refines Finance Azure’s client interactions

But it doesn’t stop there. The integrated business platform extends its functionalities to calendar and appointment scheduling, revolutionizing the way Finance Azure interacts with its clients. Now, users can effortlessly send appointment links, allowing clients and associates to directly book time slots. This feature ensures that Finance Azure remains accessible to those who need financial guidance, reinforcing their commitment to customer-centric service.

And for a firm like Finance Azure, where project timelines and tasks are paramount, IPPBX’s project and task management tools have proven invaluable. By streamlining processes and enhancing team collaboration, these features ensure that Finance Azure stays ahead of the curve, ensuring that every financial journey they oversee is meticulously planned and executed.

However, where the integrated business platform truly shines is in its state-of-the-art file sharing capabilities. In the world of finance, the security of sensitive data is paramount. IPPBX recognizes this, offering advanced file sharing where users can effortlessly share files both within and outside the organization. The optional password protection and video verification features ensure that data integrity is never compromised, a feature that Finance Azure finds crucial for their operations.

Task Mastery

Further augmenting this suite of tools is chat and video meeting functionality, allowing internal and external communication to be as seamless as possible. In an industry where clear communication can be the difference between financial success and mishap, this feature ensures that Finance Azure always remains a step ahead.

Lastly, in an age where multilingual communication has become a norm, the call transcription feature that supports over 90 languages is nothing short of a game-changer. This ensures that Finance Azure, with its diverse clientele, can serve a global audience without any language barriers.

With such a comprehensive array of tools at their disposal, it’s no surprise that Finance Azure has seamlessly integrated IPPBX’s platform into their operations. The symbiotic relationship between Finance Azure’s financial expertise and IPPBX’s integrated business platform has resulted in an unparalleled service delivery mechanism.

In conclusion, the collaboration between Finance Azure and IPPBX exemplifies the future of business operations. It’s a testament to how advanced communication tools, when paired with industry expertise, can lead to unmatched service quality. For institutions like Finance Azure, IPPBX’s integrated business platform has not only streamlined operations but also fortified their position as leaders in financial guidance. This alliance symbolizes the power of modern technology and industry expertise, and it sets a benchmark for others to follow.

Business

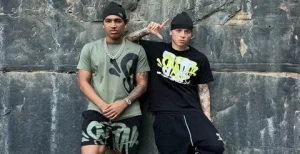

Discover Raspberry Hills: The Rising Star in Streetwear

If you’ve been keeping an eye on the latest streetwear trends, there’s a good chance you’ve come across Raspberry Hills. If not, don’t worry — you’re about to get the scoop.

Raspberry Hills is making waves in the fashion world with its bold designs, clean cuts, and that effortless “I woke up like this” vibe. Whether it’s the iconic Raspberry Hills hoodie, the sharp tracksuit, or the statement-making camo shorts, this brand is carving out a serious name for itself in street fashion. It’s more than just clothing — it’s a statement of confidence, style, and a laid-back yet bold approach to everyday fashion.

Raspberry Hills Apparel: Beyond Clothing — It’s a Way of Life

Streetwear today isn’t just about wearing loud, flashy clothes; it’s about exuding confidence and letting your outfit do the talking. And that’s exactly what Raspberry Hills is all about. Their pieces give you a way to look effortlessly put-together, so you can step out feeling comfortable, stylish, and confident — without the need for over-the-top effort. It’s about wearing pieces that express who you are without needing a word.

What makes Raspberry Hills stand out is that it keeps its designs fresh and accessible. The brand caters to those who want to stay stylish while embracing the idea that fashion should feel natural. This approach is particularly appealing to the current generation of streetwear enthusiasts who want versatility and practicality, all while maintaining a certain edge.

The Raspberry Hoodie: An Instant Essential

Let’s face it — a hoodie is a must-have in any streetwear collection. But the Raspberry Hills hoodie? It’s anything but basic. The fit is just right: slightly oversized but not drowning you, giving off that cool, laid-back vibe that’s perfect for a quick outing or layering up for something a little more chill. It’s the kind of piece that makes you look styled without even trying.

And the fabric? It’s soft, breathable, and comfortable — no stiff, uncomfortable material here. You know the type of hoodie that feels like a second skin? That’s the Raspberry Hills hoodie. Whether you’re lounging at home, running errands, or just hanging with friends, it offers the perfect combination of comfort and style. You can throw it on and instantly elevate your outfit, no matter how casual the occasion.

The Raspberry Hills Tracksuit

Matching sets are having a moment right now, and the Raspberry Hills tracksuit takes that to the next level. Gone are the days of stressing over what goes with what. With a tracksuit, the outfit is already done for you. Just throw it on, and boom — you’ve got a stylish, coordinated look that doesn’t require much effort.

What’s great about the Raspberry Hills tracksuit is that it doesn’t just look good; it feels good, too. The material is both comfortable and practical, making it perfect for a range of activities. Whether you’re out for a casual day in the city, hitting the gym, or lounging at home, the tracksuit’s versatility makes it a go-to piece. The clean lines and sleek design give off an air of confidence, making it the ultimate choice for anyone who wants a polished yet effortless look.

The best part? Tracksuits are not just for athletic wear anymore. They’ve evolved into an essential part of modern street fashion, and Raspberry Hills perfectly captures this shift. You can wear it as a full set or mix and match it with other pieces — either way, you’re getting a clean, put-together look without any stress.

Raspberry Hills Camo Shorts: Your Summer Statement Piece

When it’s time to turn heads, the Raspberry Hills camo shorts are your go-to. Camo is a streetwear staple, but Raspberry Hills keeps it fresh and modern, so you can rock it without worrying about looking outdated. These shorts blend the classic camo print with updated design elements, making them stand out in a way that’s both bold and understated.

The best part about the Raspberry Hills camo shorts is how easy they are to style. Pair them with a simple tee or a solid-colored hoodie, and you’ve got a look that’s both stylish and effortless. These camo shorts aren’t just about the print; they’re about attitude. Bold enough to catch attention but relaxed enough to keep your style effortlessly cool.

Summer streetwear has never looked this good. Camo remains a timeless choice in street fashion, but Raspberry Hills reimagines it to keep things fresh and exciting. Whether you’re hitting the streets, the beach, or just lounging in the park, these shorts will definitely elevate your warm-weather wardrobe.

Why Raspberry Hills Clothing Is Gaining Traction

Raspberry Hills is rising fast in the streetwear scene because it taps into what people really want — clothing that’s wearable, stylish, and comfortable. Gone are the days of overpriced hype pieces that sit in your closet, never truly serving a practical purpose. Raspberry Hills brings you:

- Comfort: The hoodie and tracksuit feel cozy and functional, while the camo shorts are breathable and perfect for warmer months.

- Confidence: The designs are bold yet easy to wear, without looking overdone. Each piece allows you to express your unique style, effortlessly.

- Versatility: From the tracksuit to the camo shorts, every piece is designed to be mixed and matched, allowing for endless styling options. You can wear Raspberry Hills clothing for almost any occasion, from casual meet-ups to lounging at home.

People are looking for pieces that last, and Raspberry Hills delivers. The brand’s dedication to quality and design distinguishes it from other streetwear labels.

How to Style Raspberry Hills Without Overdoing It

The key to rocking Raspberry Hills is keeping your look balanced. Here are a few styling tips:

- Camo shorts: Keep the top simple. A plain tee or hoodie will let the camo be the star of the show. If you want a more elevated look, throw on some chunky sneakers to complete the outfit.

- Bold hoodie: Pair with neutral or plain pants to keep things relaxed but still stylish. You can also layer it with a denim jacket or a light bomber for cooler weather.

- Full tracksuit: If you’re going head-to-toe Raspberry Hills, keep accessories minimal. The set speaks for itself. Opt for a clean, simple cap or sneakers to round out the look.

In streetwear, less is often more. Confidence over clutter is the key to nailing the look. You don’t need to over-accessorize or try too hard — just let the pieces speak for themselves.

Is Raspberry Hills Worth It?

Short answer: Yes.

Raspberry Hills is all about making streetwear that feels designed for real people who live in their clothes. Whether you’re out with friends, traveling, or just posting an outfit online, these pieces hold their own. The brand doesn’t just follow trends; it sets them.

- The hoodie becomes a go-to for casual days.

- The tracksuit is your easy outfit hack for when you want to look good without the stress.

- The camo shorts are your summer flex that shows off your style without trying too hard.

Raspberry Hills is about clothing that stands the test of time, with pieces that stay relevant year after year.

Conclusion

Raspberry Hills is more than just another name in streetwear; it’s building a solid foundation with pieces that are clean, wearable, and full of confidence. If you’re looking to upgrade your wardrobe with pieces that hit all the right notes, Raspberry Hills is definitely worth checking out. It’s a brand that understands the balance between comfort, style, and confidence — three elements every streetwear enthusiast needs.

Business

Rebuild Your Business Credit Score: Strategies for Success

A bad credit score for business puts your company in a difficult situation. You are unable to obtain the loans that you require to expand. The suppliers do not want to offer you good terms of payment. Your company is caught in a rut and seems to be unable to keep up as competitors are ahead.

Your credit score with the business can be rebuilt gradually. It is not going to come overnight. However, with practice, you will see an improvement in your score. Businesses that have progressive improvement with time are rewarded by the credit system.

Ways to Rebuild Business Credit Score

Dispute Errors and Outdated Information

Your credit report might have mistakes. These errors can drag down your score unfairly. You need to check all three major agencies, such as Experian, Equifax, and Credit safe.

You can file disputes directly with each agency when you spot problems and you can send it right away. This might include paid invoices, bank statements, or letters confirming cleared debts.

The County Court Judgments (CCJs) can actually vanish if you pay within a month. You’ll need to apply to the court directly. The satisfied CCJs stick around for six years, but at least they’re marked as paid.

Been linked to a company you never directed? You can challenge it. The credit agencies must investigate and respond within 28 days by law. Stay on top of them if they miss this deadline.

- Look for name spelling errors that link others’ debts to you

- Check for duplicate entries that count negatives twice

- Search for outdated addresses that might miss positive records

- Review director associations from companies you’ve left

- Examine expired CCJs that should have dropped off already

Pay Off Outstanding Debts and CCJs

Active CCJs hurt your score most severely. You can target these first to stop the bleeding. Next, tackle defaults from largest to smallest to maximize score improvement. The creditors may accept partial settlements if you negotiate well.

You can get loans to clear your debts and can apply for online bad credit loans in the UK. You can use this to consolidate multiple business debts. These loans can simplify your repayment schedule and potentially improve cash flow. They often approve businesses with troubled credit histories. Some lenders specialize in helping companies rebuild their financial standing.

You can ask creditors to update your status to “satisfied” once you’ve paid. This won’t remove the black mark entirely, but it shows you’ve made good. HMRC debts deserve special attention. These tax authorities report payment behavior to credit agencies.

- Set up direct debits for minimum payments

- Keep payment receipts as proof for at least two years

- Consider the snowball method

- Photograph “paid in full” letters for your records

- Request written confirmation

File Accounts and Returns on Time

Late Companies House filings damage your score. The credit agencies check this public data constantly. Your confirmation statement comes due yearly, and mark this date clearly in your calendar.

Annual accounts follow strict deadlines based on your company structure. These deadlines can trigger automatic penalties starting at £150 and climbing quickly. These fines reach £1,500 quickly for public companies.

You can set multiple reminders 30, 15, and 5 days before deadlines. This could be phone alerts, email notifications, or anything else. This simple habit prevents costly mistakes that hurt your score for years.

Your consistent filing builds trust with credit agencies over time. They track your pattern, not just individual events.

- Use accounting software

- Consider changing your company’s accounting reference date

- File online rather than by post to avoid mail delays

- Keep Companies House authentication codes

- Check your filing status online regularly

Build Positive Payment History

You pay suppliers before the due date. You can find trade credit accounts that actually report to agencies. Not all do! Ask potential suppliers directly if they share payment data. Business credit cards, when paid in full monthly, create positive records quickly.

You put utility bills in your business name rather than your personal. These regular payments build history steadily.

The big suppliers report more consistently than the smaller ones. Their data carries more weight with credit agencies. You can balance your payment strategy to prioritize these key relationships.

- Ask existing suppliers to increase credit terms after 3-4 months of early payments

- Set up automated payments for recurring bills to avoid oversights

- Space out payments to create more positive reporting events

- Consider trade credit insurance to protect your payment history

- Review payment terms before agreeing to them

Manage Director’s Personal Credit

Many lenders check both business and director credit scores. They’re linked closely in their lending decisions. Personal CCJs, IVAs, or bankruptcies severely limit business borrowing options.

You can keep your personal credit card usage under 30% of available limits. This ratio matters more than the actual amounts. You can register on the electoral roll at your business address to strengthen the connection between personal and business identities.

Separate personal and business finances completely. You use different cards, accounts, and payment methods. Joint liability continues even after leaving a company, so check your associations regularly.

You can get online bad credit loans in the UK. This can sometimes bridge personal finance gaps without impacting business credit. These lending options understand entrepreneurial challenges. They often look beyond traditional credit scores. Some offer flexible repayment terms suited to fluctuating business income.

- Check your personal credit file with all three major agencies

- Dispute any errors on personal reports

- Avoid multiple credit applications in short timeframes

- Close unused credit accounts

- Maintain a perfect payment history on a personal credit card

Establish Trade References

It is possible to open accounts with suppliers who submit payment information. There are 3-5 critical relationships that you can target to establish a strong foundation. You can begin with simple credit limits, which you can easily settle off early.

A builder, merchants, and office suppliers are the usual ones reporting to credit agencies. These industries are good entry points. After six months of flawless payments, ask for small credit gifts to indicate improvement.

Some loan applications require written trade references. These can be inquired of contented suppliers once a good history has been built.

- Go on business with the finance departments of supplier companies

- Prepare congratulatory letters when the credit limit is approved

- Record all early payments that you make

- Make regular visits to suppliers every three months

Conclusion

The practices could appear small, but they accumulate in huge transformations that lenders have of your company. Record your improvement every month to keep yourself going when the process is slow.

Many successful businesses have used the bad ratings to recover and be in a position to obtain the money they required to succeed. Don’t stick to quick fixes only, but rather stick to those habits that can make your credit great.

Business

The Emotional Reasons to Choose a Brand New Townhouse in Sydney

We often talk about property in clinical terms—square meters, price points, investment returns. But anyone who has ever truly loved a home knows that the most important factors can’t be measured. They’re felt. A brand new townhouse in Sydney offers more than just a modern dwelling; it offers a place where life happens, where memories take root, and where your heart finds rest. Beyond the brochures and floor plans lies something profoundly human: the emotional journey of finding a place to call your own. Let’s explore the feelings, the hopes, and the quiet joys that make a new townhouse truly special.

1. The Feeling of Starting Fresh

There’s something uniquely powerful about being the first person to live in a home.

- A blank canvas for your life. Every wall is empty, waiting for your photos. Every room is silent, waiting for your laughter. You’re not inheriting someone else’s history or covering their marks—you’re starting completely fresh, writing your own story from the first page.

- The smell of new. That distinct scent of fresh paint, new carpet, and untouched timber isn’t just pleasant—it’s symbolic. It represents possibility, potential, and a clean slate. It’s the smell of beginnings.

- No baggage, no surprises. You won’t discover hidden problems or wonder about previous occupants. Everything is exactly as it should be, exactly as you chose it. There’s a quiet confidence in knowing your home has no secrets.

- Your mark from day one. Whether you hang artwork, arrange furniture, or simply place your favourite books on a shelf, every choice is yours. The home becomes yours immediately, not years down the track after removing someone else’s wallpaper.

2. The Peace of Mind That Money Can’t Buy

Beyond the aesthetics lies a deeper comfort: the security of knowing your home is sound.

- Sleeping soundly. No worrying about when the roof might leak, the hot water system might fail, or the wiring might need replacing. All is fresh, all is functional, all is covered by warranty. That peace of mind is priceless.

- No unexpected emergencies. The phone won’t ring with a frantic tenant or tardy delivering bad news. Your weekends aren’t consumed by urgent repairs. Your budget isn’t blown by crises you couldn’t foresee.

- A home that protects you. Modern construction means better insulation, double glazing, and energy efficiency. Your home keeps you warm in winter, cool in summer, and quiet from the outside world. It wraps around you like a protective layer.

- Confidence in quality. Builder warranties—typically six years for structural defects—mean you’re not alone if something does go wrong. There’s a safety net beneath your sanctuary.

3. The Joy of Space That Fits Your Life

There’s an emotional release that comes when your home finally matches how you actually live.

- Room to breathe. After years of squeezing into apartments or managing houses that were never quite right, finding a space that simply works feels like exhaling after holding your breath. The kitchen layout makes sense. The bedrooms feel right. The flow feels natural.

- Space for everyone. Children have room to play. Partners have space to work. Everyone can be together or alone as needed. The friction of cramped living—the constant negotiation over space—simply disappears.

- A place for your things. Beloved possessions no longer live in storage boxes. Books have shelves. Photos have walls. Your life is displayed, not hidden. There’s a deep satisfaction in surrounding yourself with what you love.

- Room to grow. That spare bedroom becomes a nursery, a study, a guest room as life evolves. Your home grows with you, adapting to your changing needs without requiring you to move.

4. The Warmth of Community

Beyond your front door lies something equally important: the feeling of belonging.

- Neighbors who become friends. New developments attract people at similar life stages—first-home buyers, young families, downsizers starting fresh. Shared experience creates natural connections. A wave becomes a chat becomes a friendship.

- Streets where children play. Safe footpaths, quiet streets, and nearby parks mean children can ride bikes, kick balls, and make friends just outside. The sound of kids laughing drifts through open windows—a reminder that life is being lived well.

- Community spaces that bring people together. Shared gardens, barbecue areas, and walking paths create natural gathering spots. A friendly chat while gardening or walking the dog can blossom into genuine connection.

- A sense of belonging. In a world that often feels disconnected, finding a neighborhood where people know each other—where you’re not just an address but a neighbor—feeds something fundamental in the human spirit.

5. The Pride of Ownership

There’s an undeniable emotional payoff in owning something beautiful that you’ve chosen.

- Coming home to something beautiful. After a long day, turning onto your street and seeing your home—fresh, modern, exactly as you wanted—lifts the spirit. It’s yours. You chose it. You earned it.

- Hosting with pride. When friends and family visit, you’re not apologizing for outdated kitchens or cramped spaces. You’re welcoming them into a home that reflects your taste and your achievements. There’s quiet satisfaction in sharing something you’re proud of.

- Building something lasting. This isn’t just a place to sleep—it’s the foundation of your future. Every mortgage payment builds equity. Every year adds value. You’re not just living; you’re building.

- A legacy to leave. For families, a home represents something passed down. Memories made here will be remembered forever. Children will return as adults and say, “I grew up there.” That matters.

6. The Simple Joy of Morning Coffee

Sometimes the deepest emotions come from the smallest moments.

- Coffee on the balcony. Watching the sun rise over your own private outdoor space, cup warm in your hands, birds beginning to sing. No rush, no noise, no one else. Just you and the morning.

- Watching children play. Seeing your kids laugh in a garden that’s safely enclosed, knowing they’re secure, hearing their joy drift through the window. That sound is the sound of everything going right.

- Dinner with friends. The table full, glasses clinking, conversation flowing from kitchen to courtyard. Your home, full of people you love, working exactly as you imagined.

- Quiet evenings alone. Curled up with a book, the house settled around you, everything in its place. The peace of being exactly where you belong.

- Waking up on weekends. No alarm, no rush, just the gentle realization that you’re home, it’s yours, and the day stretches ahead with possibility.

7. The Feeling of “Enough”

Perhaps the deepest emotion a home can offer is the quiet sense of having found what you need.

- Not wanting more. After years of searching, compromising, and making do, you finally have a home that doesn’t leave you wishing. It’s not perfect—no home is—but it’s enough. It’s yours. It’s right.

- Contentment. The restless searching stops. The scrolling through real estate apps late at night fades away. You’re not looking anymore because you’ve found it.

- Gratitude. Walking through your home, you occasionally pause and think: this is mine. This is where I live. This is where my life happens. And it’s good.

- Roots. You can finally put down roots, deep ones. Join the local library. Find a regular cafe. Know your neighbors’ names. Become part of something.

8. A Home for All Your Tomorrows

A brand new townhouse isn’t just for who you are today—it’s for who you’re becoming.

- For the career change ahead. That flexible room becomes a home office when you finally start your own business.

- For the baby on the way. The spare bedroom becomes a nursery, painted and prepared with love.

- For the parents getting older. A ground-floor bedroom means they can visit comfortably, or eventually stay when they need support.

- For the retirement ahead. Low-maintenance living means your home remains manageable as you age, allowing you to stay in the community you love.

- For the memories yet to be made. First birthdays, teenage parties, graduation dinners, quiet anniversaries. Your home will hold them all.

Is Your Heart Ready?

Sometimes the logical arguments for buying a home—the investment, the space, the location—are really just covers for something deeper. We want a place where we feel safe, where we belong, where we can be ourselves. A brand new townhouse in Sydney offers all of that and more. It’s not just a house. It’s where your heart can finally rest.

Find the Home Your Heart Deserves with NewSquares

At NewSquares, we understand that buying a home is an emotional journey. We’re here to help you find not just a property, but a place where your life can unfold beautifully. Our team specialises in brand new townhouses across Sydney that are designed for real people, real families, and real hearts.

-

Business3 years ago

Cybersecurity Consulting Company SequelNet Provides Critical IT Support Services to Medical Billing Firm, Medical Optimum

-

Business3 years ago

Team Communication Software Transforms Operations at Finance Innovate

-

Business3 years ago

Project Management Tool Transforms Long Island Business

-

Business2 years ago

How Alleviate Poverty Utilized IPPBX’s All-in-One Solution to Transform Lives in New York City

-

health3 years ago

Breast Cancer: The Imperative Role of Mammograms in Screening and Early Detection

-

Sports3 years ago

Unstoppable Collaboration: D.C.’s Citi Open and Silicon Valley Classic Unite to Propel Women’s Tennis to New Heights

-

Art /Entertainment3 years ago

Embracing Renewal: Sizdabedar Celebrations Unite Iranians in New York’s Eisenhower Park

-

Finance3 years ago

The Benefits of Starting a Side Hustle for Financial Freedom